The State of the Tulsa Real Estate Market in 2025

The Tulsa real estate market in 2025 is entering a new phase—one shaped by steady population growth, continued affordability compared to national averages, and evolving buyer and seller expectations. Whether you’re a first-time buyer, a move-up buyer, a downsizer, or relocating to the Tulsa metro, understanding how today’s prices, inventory levels, and economic factors fit together will help you make confident decisions in the year ahead. As someone who has lived in Broken Arrow since 1995 and sold homes across the Tulsa area for more than two decades, I’ve seen the market shift through many cycles. And while every year brings surprises, 2025 is already showing clear trends worth paying attention to.

Tulsa Home Prices 2025: Where Things Stand Now

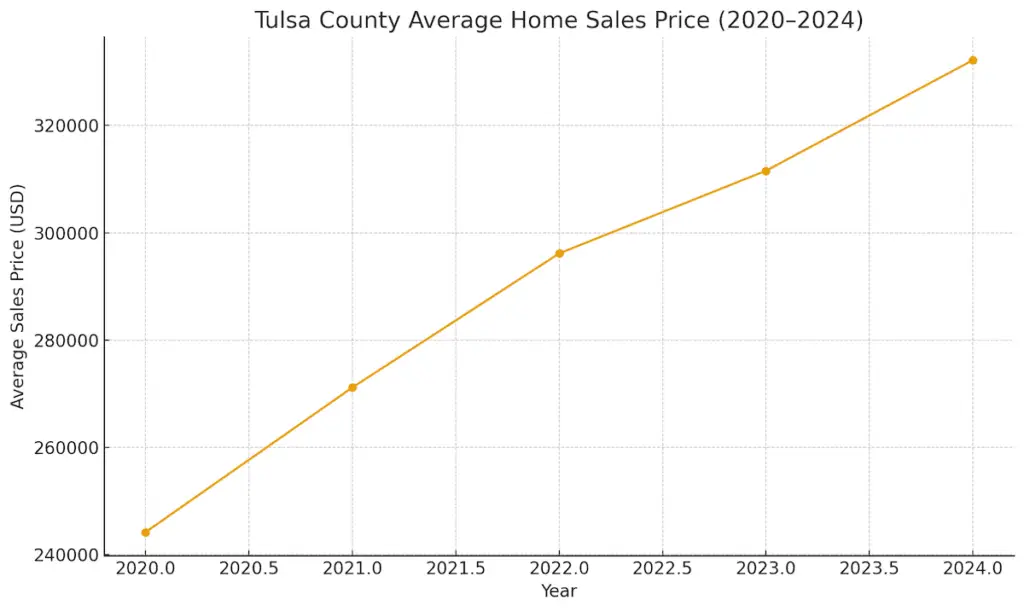

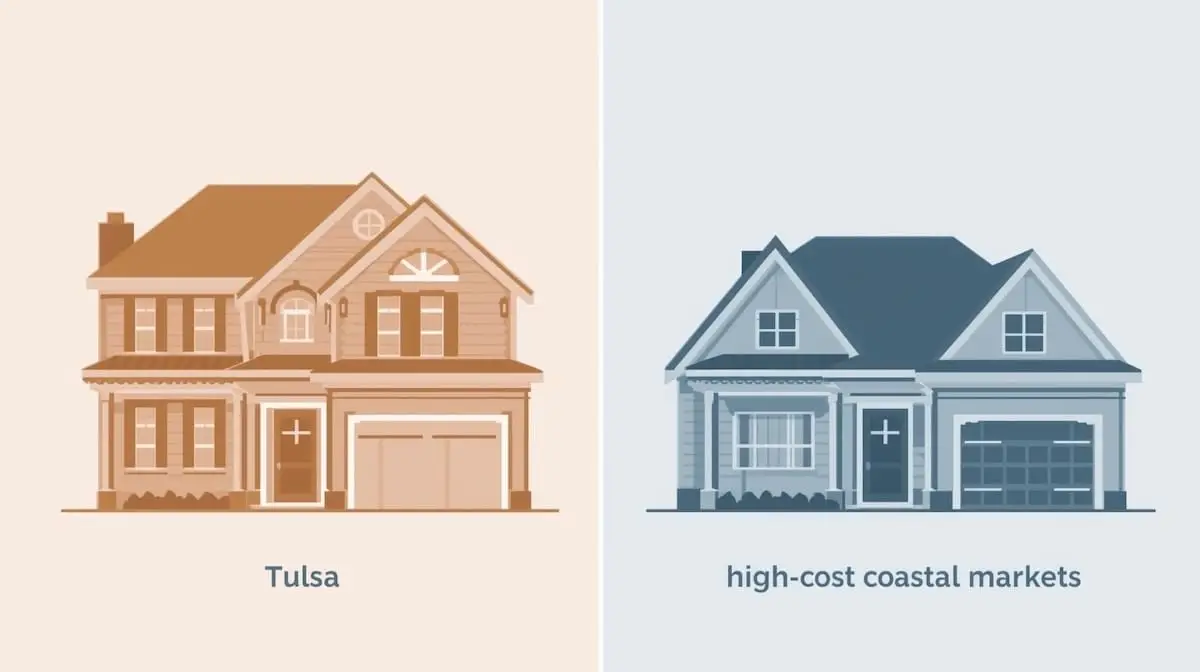

Tulsa’s housing market has entered 2025 with steady, moderate price growth—striking a balance between continued affordability and the sustained demand that has defined the region for the past several years. Unlike many volatile coastal markets, Tulsa’s price trends have remained consistent, largely due to stable job sectors, manageable inventory levels, and ongoing migration from higher-cost states. For buyers, that stability provides clarity; for sellers, it supports confidence in listing decisions.

Current Median Prices Across the Tulsa Metro

While exact figures shift month-to-month, early 2025 data shows that most areas in the Tulsa metro experienced a 2–6% year-over-year increase. Below is a simplified view of how median prices are trending across popular suburbs and Tulsa proper. (Values are approximate and used for general market insight.)

| Area / City | 2024 Median Price | 2025 Median Price (Est.) | YOY Change | Notes |

|---|---|---|---|---|

| Tulsa (Citywide) | $220,000 | $228,000 | +3.6% | Strong demand for updated homes; older homes drive variability |

| Broken Arrow | $285,000 | $300,000 | +5.3% | High demand; strong schools; balanced resale + new construction |

| Bixby | $360,000 | $380,000 | +5.5% | New construction surge; luxury and move-up buyers active |

| Jenks | $350,000 | $365,000 | +4.3% | Limited inventory at entry-level; competitive resale market |

| Owasso | $315,000 | $330,000 | +4.8% | Popular for relocations; strong appreciation trends |

| Midtown Tulsa | $275,000 | $290,000 | +5.4% | High demand for charm homes; competition remains steady |

These figures illustrate why Tulsa home prices 2025 are front-of-mind for buyers, sellers, and especially relocating families who often compare Tulsa to much higher-priced metros.

What’s Driving Price Growth in 2025?

1. Supply Remains Lower Than Ideal

The metro continues to sit below a balanced 5–6 months of inventory. While inventory has improved slightly since 2023, it is still tight in popular neighborhoods like Brookside, Florence Park, and key suburban school districts.

2. Continued Population Growth

Steady in-migration from states such as California, Colorado, and Texas fuels demand—often from buyers who see Tulsa as a more affordable, lifestyle-focused alternative.

3. New Construction Pushes Pricing in the Suburbs

Builders remain very active in Bixby, Broken Arrow, and Owasso. Their price points often set the upper end of the market, pulling neighboring resale values upward.

4. Renovated Homes Command a Premium

Updated and turnkey homes continue to sell faster and at higher percentages over list price because many buyers prefer move-in-ready over renovation.

Where Prices Are Rising the Fastest

Certain pockets of the metro saw stronger-than-average appreciation:

Bixby: Driven by new neighborhoods, large lots, and strong schools

Jenks: Limited resale supply boosts competition

Owasso: Popular with relocators and military families

Midtown & Brookside: Highest premiums for character homes and walkability

Meanwhile, areas with more dated housing stock or higher renovation needs saw more modest growth.

How Tulsa Compares to National Trends

National markets experienced wide swings over the last several years, but Tulsa continues to show:

Stable appreciation instead of sharp spikes

Lower overall price volatility

More predictable seasonal patterns

Better affordability for both first-time buyers and move-up buyers

Compared to the national median price (hovering near $400,000+), Tulsa remains one of the most accessible metro markets in the United States

What This Means for Buyers and Sellers

For buyers, the gradual rise in prices means acting earlier in the year may offer an advantage before spring surge pushes values higher. For sellers, the stability reinforces strong listing opportunities, particularly for well-maintained homes in the most sought-after suburbs.

Market Trends Shaping Tulsa Real Estate in 2025

The Tulsa real estate market in 2025 is being shaped by a combination of predictable regional patterns and new dynamics emerging from post-pandemic migration, generational shifts, and evolving affordability. While Tulsa remains one of the most stable and affordable metros in the country, several meaningful trends are influencing how buyers and sellers approach the market this year.

Shifting Inventory Levels

Inventory remains below what’s considered a “balanced market,” although it has improved slightly compared to the tightest years of 2021–2023. For context:

Entry-level homes under $250,000 continue to see strong competition.

Mid-range homes between $300,000–$450,000 move quickly in suburbs like Broken Arrow, Owasso, Jenks, and Bixby.

Higher-end homes above $600,000 benefit from longer days on market but face less buyer pressure than in previous years.

The gap between new construction and existing resale homes continues to influence the pace at which certain buyers can enter the market.

Days on Market: Slowly Increasing but Still Healthy

Homes in Tulsa spent longer on the market in late 2024 compared to two years prior, but the increase is modest. Well-priced, well-maintained homes—especially those updated within the last 10 years—still sell within 7–20 days in most suburbs. In central Tulsa neighborhoods like Midtown or Brookside, character homes often move quickly if priced correctly.

Properties needing work or priced too aggressively experience the longest listing times, showcasing how price sensitivity has become more pronounced.

The Impact of New Construction

New construction continues to reshape demand patterns in 2025. Builders such as DR Horton, Lennar, Capital Homes, Simmons, J. Davis, Executive Homes, Schuber Mitchell, and Concept Builders have expanded their presence—especially in Bixby, Jenks, South Tulsa, and Broken Arrow.

This has created several key market impacts:

More move-up buyers are choosing new homes for modern layouts and energy efficiency.

Increased builder incentives affect resale sellers who must price strategically.

Suburbs with active development remain some of the fastest-growing and highest-demand areas in the Tulsa metro.

For a deeper dive, you might also like reading about new construction homes in the Tulsa metro.

Evolving Buyer Demand and Preferences

Buyer needs have shifted in ways that directly impact what sells:

Larger Kitchens & Open Layouts: Still highly desirable, especially for families and move-up buyers.

Energy Efficiency & Low Maintenance: New builds and updated homes have an advantage as utility costs and maintenance expectations rise.

Outdoor Living: Patios, covered porches, and usable yard space continue to drive value.

Office or Flex Rooms: Remote work isn’t disappearing, and flexible floorplans remain a priority.

Buyers relocating from higher-cost states often seek homes that would be unattainable in their previous markets—helping sustain demand even with interest rate fluctuations.

Demographic Shifts: Who’s Driving Demand?

Three groups in particular shape Tulsa real estate market 2025 demand:

First-time buyers: Attracted by affordability and strong suburban schools.

Move-up buyers: Motivated by lifestyle changes, new construction, or needing more space.

Relocators and retirees: Drawn by lower costs, slower pace, and lifestyle amenities around the metro.

This mix creates a steady buyer pool that keeps demand strong across most price points.

Seasonal Patterns Returning

After several unpredictable years during and after COVID, Tulsa has returned to more typical rhythms:

Spring: Fastest sales and strongest competition

Summer: Family-driven demand peaks

Fall: Price adjustments and negotiability

Winter: Quiet but motivated buyers

Understanding these seasonal cycles helps both buyers and sellers make better-timed moves.

Interest Rates & Affordability in Tulsa

Interest rates played a defining role in how buyers and sellers approached the Tulsa market in 2023 and 2024, and they’re continuing to influence behavior in 2025. While rates have stabilized compared to the sharp increases of previous years, affordability remains a central concern—especially for first-time buyers and anyone comparing monthly payments across different price points. Even with these challenges, Tulsa continues to stand out nationally for its balance of affordability and value.

How Current Mortgage Rates Are Affecting Buyer Demand

Mortgage rates in early 2025 remain higher than the historically low rates of 2020–2021 but lower than the peak periods that briefly cooled buyer activity. This has created a more predictable lending environment.

Key buyer behaviors emerging in 2025:

Buyers focus more on monthly payment comfort than on total price.

Adjustable-rate and temporary buydown programs are more widely considered.

Many renters are realizing that buying in Tulsa is still more affordable than renting long-term.

Relocating buyers often view Tulsa homes as “affordable” even with current rates, compared to metros like Denver, Dallas, or the West Coast.

Despite rate fluctuations, demand remains steady because Tulsa’s home prices are still significantly below national averages.

Affordability: Tulsa vs. National Averages

Affordability remains one of Tulsa’s strongest competitive advantages. Even with rising prices, the region consistently ranks among the more accessible markets for middle-income households.

Where Tulsa stands out:

Lower average down payments needed

Smaller overall mortgages due to lower price points

Lower property taxes compared to many states

Steady job market supporting buyer confidence

This combination gives Tulsa a unique position in the national landscape, making homeownership possible for households that might be priced out elsewhere.

Breakdown: What Different Price Ranges Mean for Buyers in 2025

Affordability shifts significantly by price range.

Here’s a general overview of how the most common Tulsa price tiers play out in terms of buyer activity:

Under $250,000:

Highly competitive

Ideal for first-time buyers

Older homes, some needing updates

Fastest-moving segment of the market

$250,000–$350,000:

Strongest family and move-up buyer activity

Newer construction becomes available in certain suburbs

Inventory still tight but more balanced than lower price tiers

$350,000–$550,000:

Most popular for suburban new construction

More updated homes and larger footprints

Rate-sensitive, but demand remains strong

$550,000+

More negotiability

Longer days on market

Strong interest from relocators, executives, and multi-generational buyers

This price-tier behavior helps explain why Tulsa real estate market 2025 remains resilient even in fluctuating mortgage environments.

Loan Options Shaping Buyer Choices

Buyers are increasingly strategic about loan programs in 2025:

Conventional loans still dominate mid-range and higher price points.

FHA loans become more attractive as rates adjust and down payment flexibility matters.

VA loans continue to play a major role in Owasso, Broken Arrow, and other areas with strong military relocations.

USDA loans remain an option in select rural pockets near Coweta, Skiatook, and east of Broken Arrow.

2-1 buydowns and lender incentives appear frequently in new construction communities, giving builders a competitive edge.

Educated buyers ask more questions about long-term affordability and refinance opportunities than in previous years.

Affordability Compared to Rental Costs

Tulsa’s rental market has climbed steadily, making homeownership more appealing:

Rent increases have outpaced wage growth in certain areas.

Many renters find that a mortgage payment—especially in the under-$300k range—can be similar or lower than local rents.

Rental demand supports strong investor interest, which indirectly influences buyer competition in some price segments.

External Resources

For rate monitoring and broader economic context, you may consider linking to:

Freddie Mac’s weekly mortgage rate survey or MortgageNewsDaily.com.

Tulsa Housing Market Forecast: What Experts Predict for 2025

The Tulsa housing market forecast for 2025 points toward a year of steady, sustainable growth rather than the volatility seen in many U.S. metros over the past several years. With balanced appreciation, improving inventory conditions, and strong regional job stability, Tulsa is positioned for a market that favors both well-prepared buyers and sellers who price strategically. While interest rates and national economic headlines influence behavior, local fundamentals remain the driving force behind Tulsa’s outlook.

Price Forecast for 2025: Moderate, Healthy Appreciation

Industry analysts expect Tulsa home prices to continue rising at a 2–5% annual rate—slower than the double-digit gains seen nationwide in previous years but stronger than many cooling markets. Tulsa’s price trends are shaped by several stabilizing forces:

Strong employer base (healthcare, aerospace, energy, tech, and education)

Continued relocation migration from higher-cost states

Manageable construction costs compared to national averages

Steady demand from first-time buyers and move-up buyers

While affordability challenges persist nationwide, Tulsa’s pricing remains low enough to attract new households while still supporting gradual appreciation.

Inventory Forecast: Slight Improvement but Still Below Ideal

By mid-2025, analysts expect a slow but steady increase in inventory—particularly in the $300,000–$450,000 range, where new construction continues to expand. However:

Entry-level inventory under $250,000 will remain extremely limited.

Renovated homes in Midtown Tulsa, Brookside, and Florence Park will continue to sell quickly.

Suburbs with active building—Broken Arrow, Bixby, Jenks, Owasso—may see improved selection compared to recent years.

Even with improvement, Tulsa is not expected to reach a fully balanced 5–6 months of inventory in 2025. A slight seller advantage will continue in most segments, although buyers will experience more breathing room than in the peak years.

Buyer Demand Forecast: Strong for Suburban & Move-Up Markets

Demand is expected to remain strongest among:

Relocators seeking affordability

Move-up buyers wanting more space or newer homes

First-time buyers driven by rental cost increases

Families prioritizing school districts in Broken Arrow, Bixby, Jenks, and Owasso

Notably, experts predict:

Homes priced under $350,000 will remain the most competitive.

New construction will pull demand toward suburban growth corridors.

Relocators will continue shaping demand, particularly for mid-range and executive-level homes.

Mortgage Rate Influence: Stability Creates Predictability

Rates remain one of the biggest variables shaping the Tulsa real estate market 2025. Most forecasts anticipate:

Gradual easing or stabilization of mortgage rates

More buyers re-entering the market after “waiting out” the sharp increases of 2023–2024

Builders continuing to offer rate buydowns, keeping new construction competitive

Even with higher-than-pandemic-era rates, Tulsa’s affordability keeps demand resilient. Analysts agree that if rates trend downward—even slightly—Tulsa could see another surge of buyer activity through summer and fall.

Are We in a Buyer’s, Seller’s, or Balanced Market?

Experts expect Tulsa to remain a slight seller’s market for most of 2025, with some pockets shifting toward balanced conditions.

Slight Seller’s Market:

Homes under $350k

Renovated homes in Midtown, Brookside, South Tulsa

Highly desirable school districts in BA, Bixby, Jenks, Owasso

Balanced Market:

$400k–$600k price points

New construction neighborhoods with higher supply

Buyer-Friendly Pockets:

Homes needing updates

Higher-end luxury over $800k

Rural or outer areas without large buyer pools

This blend creates a dynamic market where preparation and pricing strategy matter more than ever.

Tulsa vs. National Forecast: Why Tulsa Continues to Outperform

Compared to cities experiencing big corrections or affordability crises, Tulsa stands out with:

Lower average mortgage burdens

Lower property taxes

Stable, predictable appreciation

Continued economic investment and job growth

A strong appeal to relocating families and retirees

Tulsa’s forecast is one of moderation rather than fluctuation—an advantage for buyers and sellers seeking stability

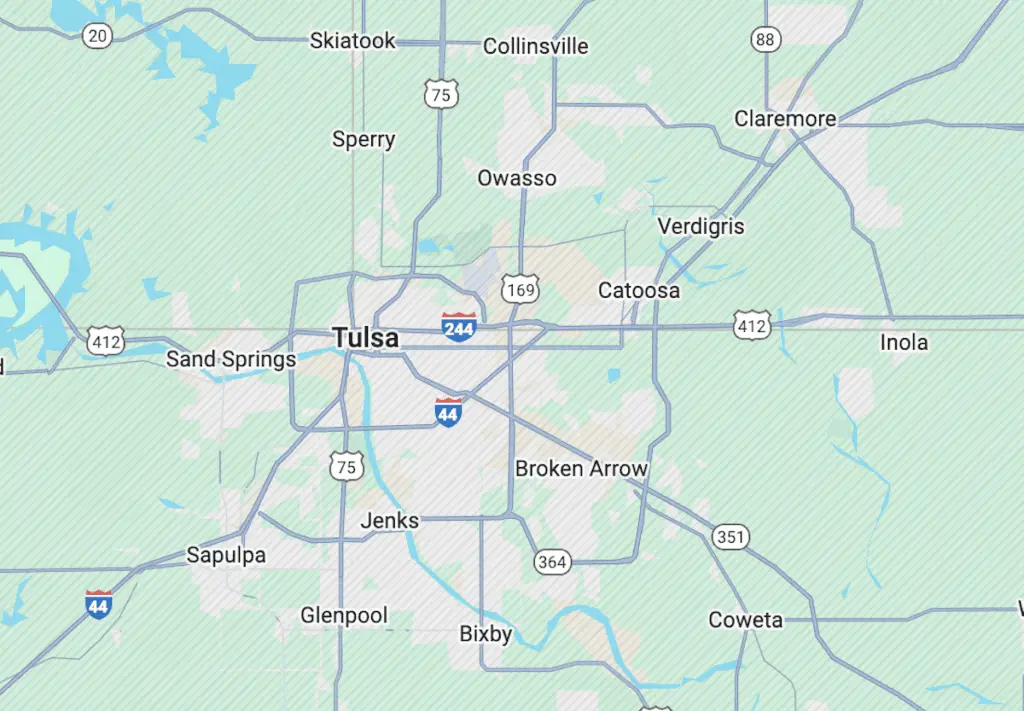

Neighborhood-by-Neighborhood Breakdown

The Tulsa real estate market is not one single market—it’s a collection of distinctly different micro-markets shaped by school districts, commute times, lifestyle preferences, housing age, and new construction availability. Understanding these neighborhood trends is essential for interpreting how the Tulsa real estate market 2025 is performing at a deeper level. While the metro remains broadly affordable, appreciation, buyer demand, and inventory vary widely depending on where you look.

Tulsa Proper: Midtown, Brookside, and Central Tulsa

These centrally located neighborhoods remain some of the most in-demand areas for buyers who value character architecture, walkability, and proximity to dining and entertainment.

Key Traits:

Bungalows, mid-century homes, and historic properties

Strong appeal to young professionals and downsizers

Higher demand for renovated homes

Market Behavior in 2025:

Renovated homes sell very quickly

Fixer-uppers stay longer on the market and require realistic pricing

Inventory remains limited due to smaller neighborhood sizes

Who This Area Attracts:

Buyers who want charm, proximity to downtown, and established neighborhoods.

You might also like reading about Tulsa Neighborhoods & Lifestyle.

South Tulsa: Luxury, Convenience, and Planned Communities

South Tulsa includes desirable pockets like South Sheridan, Yale Corridor, and neighborhoods around 101st–121st. Many homes are built from the 1990s through the early 2000s and offer larger layouts, three-car garages, and strong school connections.

Key Traits:

Larger two-story homes, updated interiors, family-friendly subdivisions

Strong school appeal without the cost of new construction

Close to parks, shopping, and major employers

Market Behavior in 2025:

Competitive for well-maintained homes

Slightly longer days on market for homes needing updates

Higher demand among move-up buyers

Broken Arrow: One of the Fastest-Growing Cities in Oklahoma

Broken Arrow continues to lead the metro in the number of new listings and new construction communities. It’s a favorite among families thanks to its schools, affordability, and wide range of housing options.

Key Traits:

Excellent schools and amenities

Mix of established neighborhoods and large new developments

Diverse price points from starter homes to executive properties

Market Behavior in 2025:

Homes under $350k remain highly competitive

New construction in south and east BA drives price consistency

Appreciation expected to remain above metro average

Buyer Profile:

First-time buyers, move-up buyers, relocators, and anyone valuing strong schools.

Bixby: Rapid Growth and High Demand

Bixby’s growth remains among the strongest in the metro thanks to its schools, newer home inventory, and desirable suburban lifestyle. Many relocators specifically target Bixby due to its balance of affordability and newer developments.

Key Traits:

Abundance of new construction

Larger homes, modern layouts, open concepts

Strong community amenities and school reputation

Market Behavior in 2025:

Homes in the $350k–$500k range move quickly

New construction incentives help buyers offset interest rate concerns

Appreciation expected to remain consistent due to demand

Jenks: High-Performing Schools and Premium Demand

Jenks holds one of the strongest reputations in the metro because of its award-winning school district and proximity to the Arkansas River and the Jenks Riverwalk.

Key Traits:

Mix of newer developments and established subdivisions

Top-tier school district drives demand

Competitive for renovated and turnkey homes

Market Behavior in 2025:

Limited supply in popular subdivisions

Higher buyer pressure in spring and early summer

Strong resale values supported by school-driven demand

Owasso: Stable Growth and Relocation Appeal

Owasso continues to attract families and relocators due to its schools, shopping, new business development, and easy access to major employers.

Key Traits:

Many newer neighborhoods with family-friendly layouts

Strong retail and dining presence

Convenient commute to Tulsa, Collinsville, and the Port of Catoosa

Market Behavior in 2025:

Consistent appreciation year over year

Popular among military families and relocators

Strong mid-range demand in the $300k–$450k segment

Downtown & Surrounding Districts: Urban Living on the Rise

Downtown Tulsa—and nearby areas like the Arts District, Greenwood District, East Village, and Pearl District—continue evolving into vibrant residential hubs.

Key Traits:

Condos, lofts, townhomes, and adaptive reuse projects

Appeal to young professionals and downsizers seeking low-maintenance living

Walkability to restaurants, bars, venues, and festivals

Market Behavior in 2025:

Inventory is limited but steady

Demand strongest for modern units with secure parking

Appreciation remains stable due to ongoing urban revitalization

Summary: Why Neighborhood Trends Matter in 2025

Because different neighborhoods experience unique patterns in pricing, inventory, and buyer demand, understanding these micro-markets helps both buyers and sellers set realistic expectations. In 2025:

Suburban growth corridors (Broken Arrow, Bixby, Owasso, Jenks) lead in appreciation

Central Tulsa (Midtown/Brookside) remains competitive for renovated homes

South Tulsa maintains its role as the move-up buyer hub

Downtown districts continue to grow as lifestyle preferences evolve

Each neighborhood tells its own story—and together they paint a fuller picture of the Tulsa real estate landscape.

New Construction and Builder Activity in the Tulsa Metro

New construction continues to play a defining role in the Tulsa real estate market 2025, shaping everything from pricing trends to buyer expectations. With sustained in-migration, evolving lifestyle needs, and a strong preference for turnkey homes, the demand for new builds remains high across the metro. Builders have responded by expanding into new subdivisions, offering rate incentives, and diversifying floorplans to appeal to everyone from first-time buyers to luxury shoppers. Understanding where and how new construction is growing provides important insight into inventory trends, appreciation rates, and buyer behavior this year.

Why New Construction Matters in 2025

New homes help set pricing expectations in major growth corridors, influence resale demand, and anchor long-term neighborhood development. In the Tulsa area, new construction is more attainable than in many metros nationwide because land costs, labor costs, and permitting remain comparatively manageable.

Key drivers of new construction demand include:

Desire for modern layouts and open concepts

Energy-efficient features and lower maintenance expectations

Builder incentives offering temporary rate buydowns

Fewer renovation needs compared to aging resale inventory

Growing family populations in suburban school districts

This combination ensures that new construction remains an essential part of the Tulsa housing ecosystem.

Where New Construction Is Booming in 2025

Growth is concentrated in the suburbs, but each area has its own appeal and price range.

Broken Arrow

Broken Arrow continues to lead the metro in the number of newly built homes. East and South BA have the largest share of developing subdivisions, and planned communities with parks, trails, and amenities remain attractive to families.

Bixby

One of the strongest growth corridors in Oklahoma. Builders here capitalize on the demand for larger homes, family-friendly communities, and proximity to top-tier schools.

Jenks

Jenks’ new construction is highly competitive due to limited land availability and strong school district appeal. Projects tend to skew toward mid-range and upper-tier prices.

Owasso

Owasso’s growth is stable and steady, with strong demand from relocating families and military-affiliated buyers. Builders continue adding thoughtfully designed communities with easy access to highways and retail.

South Tulsa

High-end and move-up developments dominate this area, with luxury builders creating neighborhoods that offer premium features and convenient access to dining, shopping, and employers.

Notable Builders Shaping the Market

Several builders continue contributing to the inventory and pricing structure in 2025:

DR Horton – Offers entry-level and mid-range homes with consistent incentives.

Lennar – Focuses on modern, move-in-ready homes with bundled features.

Capital Homes – Popular for customizable floorplans and strong suburban presence.

Simmons Homes – Known for quality, affordability, and energy-efficient builds.

Schuber Mitchell – Growing rapidly with attractive pricing and modern amenities.

Executive Homes – A leader in luxury and semi-custom homes in South Tulsa and Bixby.

Concept Builders – Balanced mix of affordability and customizable features.

J. Davis Homes – Boutique builder with thoughtful design and craftsmanship.

True North Homes – Emerging builder focusing on stylish, modern layouts.

Butler Homes – Offers strong value and attention to detail in developing areas.

These builders shape everything from local pricing to buyer incentives, and their presence is especially strong in the mid-range segments where demand is the highest.

How New Construction Affects Resale Homes

New developments influence resale behavior in several ways:

Pricing Pressure: Resale homes often need to be competitively priced when similar new builds exist nearby.

Update Expectations: Buyers compare resale homes to modern finishes, layouts, and energy standards.

Negotiability: Builders frequently offer incentives (closing costs, rate buydowns), requiring some resale sellers to adjust their strategy.

Absorption Rates: A high volume of new listings can increase inventory levels in certain suburbs, leading to more balanced conditions.

This dynamic creates a clear divide: well-priced, updated resale homes sell quickly, while dated homes may require price adjustments or cosmetic upgrades to compete.

Buyer Preferences Driving New Construction Demand

Across the metro, buyers continue prioritizing features commonly found in new homes:

Larger kitchens with islands

Open-concept living spaces

Energy-efficient systems and insulation

Smart home technology

Main-level primary suites

Covered outdoor spaces

Ample storage and three-car garages

These preferences add upward pressure on demand for new builds, particularly among move-up buyers and relocating families.

You might also like reading about new construction homes in the Tulsa metro for a deeper breakdown of builders, pricing, and community features.

Market Conditions for Buyers in 2025

For buyers, the Tulsa real estate market 2025 offers a mix of opportunity and challenge—highly dependent on price range, property condition, and location. While the market remains competitive in certain segments, especially under $350,000, buyers have more negotiating room than during the peak years of 2021–2023. Inventory has improved modestly, seller expectations have normalized, and interest rate stabilization has helped more buyers re-enter the market. Still, preparation, strategy, and realistic expectations remain essential for success in 2025.

Affordability: Tulsa Still Outperforms Many U.S. Metros

Despite rising home prices, Tulsa remains significantly more affordable than coastal and major metro markets. Many buyers relocating from states like California, Colorado, and Texas find that Tulsa offers:

Lower purchase prices

Lower ongoing housing costs (taxes, insurance, utilities)

A higher likelihood of purchasing rather than renting

Opportunities for larger homes, bigger lots, and newer construction

Even with higher interest rates, affordability is a driving force behind Tulsa’s steady buyer demand.

Price Range Breakdown: What Buyers Can Expect in 2025

Homes Under $250,000

Most competitive segment

Limited inventory, especially for move-in-ready homes

Strong demand from first-time buyers and investors

Quick sales and multiple offers remain common

Buyers should expect to act quickly and be fully pre-approved

$250,000–$350,000

Still competitive but with more options

Mix of updated resales and smaller new construction homes

Popular with first-time and move-up buyers

Often the “sweet spot” for families prioritizing schools

$350,000–$500,000

Suburban new construction dominates this price band

More negotiability than lower ranges

Buyers often have choices among multiple floorplans

Resale homes must be updated to compete with new builds

$500,000+

Balanced conditions or slight buyer market in some areas

Longer days on market

More flexibility in contingencies and closing timelines

Highly desirable new construction and luxury homes still move well

Buyer Competition Levels in 2025

Competition varies widely depending on condition, location, and pricing.

Highly Competitive Areas:

Midtown & Brookside

Jenks school district

Bixby school district

Certain neighborhoods in South Tulsa

Updated homes under $350k in any suburb

Moderate Competition:

New construction communities in Jenks, Bixby, Broken Arrow, and Owasso

Homes priced between $350k–$500k

Lower Competition:

Homes needing updates

Higher-end properties above $750k

Rural or semi-rural locations outside the core suburbs

Updated homes command attention. Outdated homes demand realistic pricing.

Negotiation Power for Buyers

Buyers have more negotiation leverage in 2025 compared to the previous few years—especially outside the most competitive price ranges.

Buyers may secure:

Seller-paid closing costs (depending on price range)

Repairs and concessions

Longer inspection windows

Extended closings

Builder incentives (rate buydowns, upgrades, closing costs)

However, in lower price bands, buyers should still be prepared for strong competition and quick decision-making.

The Importance of Pre-Approval

Because inventory below $350k remains tight, being pre-approved—and ideally having a fully underwritten approval—gives buyers a meaningful advantage.

Pre-approval helps buyers:

Act faster

Strengthen offers

Understand their payment comfort level

Compete more effectively against multiple offers

Buyers waiting to get pre-approved risk missing the narrow window when a strong home comes to market.

Updated & Move-In-Ready Homes Still Sell Fast

Buyer preferences continue to favor homes with:

Updated kitchens and baths

Modern paint colors

Newer flooring

Energy-efficient systems

Outdoor living amenities

Homes that require major updates have a harder time commanding premium prices—even with negotiability returning to the market.

Opportunities for First-Time Buyers

First-time buyers continue to drive a significant portion of Tulsa’s demand. In 2025, they benefit from:

Reasonable down-payment programs

Homes in the $200k–$300k range still accessible

USDA and FHA loan availability

Builder incentives in entry-level new construction

You might also like reading about first-time homebuyers in Tulsa for more guidance.

Opportunities for Relocating Buyers

Relocators often find they can:

Get more space

Enter homeownership sooner

Move into highly rated school districts

Purchase newer construction within budget

This makes relocation a major demand factor pushing the 2025 market forward.

Summary: Buyer Experience in 2025

For buyers, 2025 offers more balance than the peak seller’s markets of previous years, but success still depends on preparation. Buyers who understand price tiers, move quickly on strong homes, and take advantage of local incentives have the greatest advantage—especially in the most competitive neighborhoods and school districts.

Market Conditions for Sellers in 2025

Sellers in the Tulsa real estate market 2025 are in a better position than many might expect. While the frenzy of 2021–2022 has cooled and buyers have become more price-sensitive, well-maintained and appropriately priced homes are still selling quickly—especially in high-demand suburbs and neighborhoods with strong schools. Sellers who understand how today’s buyers think, how inventory behaves in their price band, and how new construction affects the landscape can maximize both interest and sale price in 2025.

The Seller Advantage: Still Present, but More Nuanced

Tulsa remains a slight seller’s market, but conditions depend heavily on:

Price range

Neighborhood desirability

Home condition

How well the home is prepared before listing

Homes under $350k—especially updated ones—still attract multiple offers. Mid-range homes ($350k–$500k) sell well when priced strategically and presented with care. Homes above $600k perform steadily but usually with longer days on market.

This means sellers can’t rely on the automatic bidding wars of prior years. Success now comes from positioning the home correctly from day one.

Pricing Strategy Matters More Than Ever

Buyers are far more sensitive to pricing in 2025. With interest rates higher than pandemic-era lows and new construction competing across many suburbs, buyers are quick to move on if a home feels overpriced.

Strong 2025 pricing strategies include:

Pricing at or slightly below market to generate immediate interest

Using recent neighborhood comps rather than citywide averages

Adjusting expectations for homes needing updates

Recognizing that buyers will compare your home directly against new construction options

A competitively priced home often sells faster and for more money than an overpriced home that needs a reduction later.

Condition Is Crucial: Updated Homes Sell Fast

Buyers are comparing every listing to new builds and HGTV-inspired renovations. Homes that are clean, light, neutral, and well-maintained stand out immediately.

Features that help sellers win:

Fresh interior paint in modern, neutral tones

Updated or well-maintained kitchens and baths

Newer flooring

Clean and decluttered rooms

Move-in-ready condition

Good curb appeal and landscaping

Homes needing significant renovations may sit longer unless priced appropriately.

You might also like reading about preparing your home for sale.

Neighborhood and School District Impact

Demand is highest in:

Bixby

Jenks

Owasso

Broken Arrow

Midtown & Brookside (if updated)

Homes in these areas move more quickly and often receive stronger offers, especially during spring and early summer.

In contrast, homes in less-central areas or those needing updates require thoughtful pricing and preparation.

How New Construction Affects Seller Strategy

Because builders offer incentives—especially rate buydowns—resale sellers often compete against:

Brand-new homes with modern layouts

Homes where buyers don’t have to worry about repairs

Builder incentives (closing costs, upgrades, reduced rates)

Sellers in heavy new-construction areas should focus on:

Strong staging

Competitive pricing

Highlighting unique features (mature landscaping, larger lots, established neighborhood feel)

Ensuring the home shows as clean and updated as possible

Buyers are willing to choose resale—if it feels like a better value than the shiny new alternative.

Expected Days on Market for 2025

Time on market varies significantly:

Fastest-Selling Homes:

Updated

Priced correctly

Located in top school districts

Clean and staged

Under $400k

Moderate-Selling Homes:

Move-up price points ($400k–$650k)

Homes in South Tulsa, Midtown, Broken Arrow, Owasso

Clean but may need small cosmetic updates

Longest-Selling Homes:

$750k+ luxury homes

Homes needing repairs or renovations

Out-of-the-way locations

Dated interiors, heavy personalization, or deferred maintenance

Sellers who set realistic expectations have smoother transactions.

What Sellers Can Expect from Buyers in 2025

Buyers today are slower to rush into decisions unless the home is an obvious standout. They often:

Expect inspections

Ask for repairs or credits

Compare your home to new builds

Look closely at pricing relative to the neighborhood

Have higher standards for condition

This means sellers benefit from being prepared for negotiation—and presenting a home that feels worth the price.

Timing the Market: When Should Sellers List?

The strongest months for selling in Tulsa remain:

March through June (fastest sales, highest buyer activity)

Late summer (families moving before school starts)

Early fall (downsizers and relocators)

Winter offers fewer buyers—but more motivated ones—often resulting in smoother, quicker negotiations.

Summary: A Strong but More Strategic Market for Sellers

Sellers in 2025 benefit from:

Continued demand

Strong suburban school districts

Tulsa’s affordability attracting relocators

A stable appreciation outlook

But the days of “list it as-is and watch it fly” are gone. Today’s sellers succeed when they:

Price strategically

Prepare the home properly

Understand how new construction shapes competition

Work with an agent who knows the micro-markets of Tulsa deeply

Well-prepared homes still shine—and they still sell fast.

Comparing Tulsa to Other U.S. Markets

Understanding the Tulsa real estate market 2025 means looking beyond local pricing and trends to see how Tulsa stacks up against markets across the country. While many U.S. cities continue to struggle with extreme affordability challenges, high interest-rate sensitivity, and inventory shortages, Tulsa stands out for its stability, accessibility, and balanced growth. For buyers relocating from large metros—and even for long-time residents trying to interpret national housing headlines—the differences are significant.

Affordability: Tulsa Remains One of the Nation’s Most Accessible Markets

One of Tulsa’s greatest strengths is affordability. Even with moderate appreciation over the last decade, Tulsa remains far below national price averages. While the U.S. median home price sits well over $400,000, many Tulsa-area homes fall between $250,000 and $350,000.

How Tulsa stands apart:

Lower purchase prices for comparable-sized homes

Lower property taxes compared to coastal and high-growth states

Lower insurance costs than hurricane- or wildfire-prone markets

More attainable monthly payments, even with higher rates

Buyers relocating from Denver, Austin, Dallas, Phoenix, Seattle, or the West Coast frequently comment that Tulsa offers:

More house for the money

Larger lots

Newer construction at mid-range price points

Better affordability without sacrificing lifestyle

This affordability is a major factor behind Tulsa’s steady population growth.

Inventory Conditions: Stable Compared to Volatile Markets

Across the U.S., many metro areas continue to face extreme inventory shortages, but Tulsa’s market is more predictable. While inventory is not abundant, it is healthier and less volatile than many peers.

Compared to other markets:

Tulsa does not experience the severe swings of markets like Phoenix or Las Vegas

Tulsa has more inventory stability than coastal California markets

Tulsa’s new construction pipeline increases supply more effectively than land-constrained cities

Inventory growth is gradual, avoiding the sharp spikes that can destabilize prices

This stability reduces market shock for both buyers and sellers.

Price Stability: Tulsa Appreciates Without the Bubble Behavior

Some markets saw explosive growth followed by significant cooling. Tulsa’s price trends, however, remain steady.

Tulsa tends to avoid:

Double-digit annual appreciation

Sudden price corrections

Drastic year-over-year volatility

Instead, Tulsa sees:

Gradual appreciation

Predictable seasonal patterns

Consistent demand tied to population and jobs

This makes Tulsa a reliable choice for long-term homeowners and investors.

Migration Patterns: Tulsa Gains While Some Cities Lose

Many high-cost metros continue to lose residents. Tulsa, on the other hand, benefits from incoming migration driven by:

Affordability

Remote work flexibility

Desire for lower-density, suburban living

Strong school districts in Jenks, Bixby, Owasso, and Broken Arrow

A stable job base with opportunities in aerospace, healthcare, energy, and tech

Relocators often report that Tulsa offers a quality of life that feels like a “step up,” even when moving from major cities.

New Construction Access: Tulsa Has What Many Cities Can’t Offer

Land availability in suburban areas allows Tulsa to grow in ways that many metros cannot.

Advantages of Tulsa’s development model:

Larger new homes at attainable price points

Diverse builder options

Neighborhood amenities like parks, trails, and community pools

More consistency in pricing

Less competition for land

Contrast this with coastal cities where new construction is rare or prohibitively expensive.

Investment Outlook: Stronger Than Many Cooling Markets

Because Tulsa remains affordable with consistent rental demand, it maintains a positive reputation among long-term investors.

Tulsa outperforms markets with:

High vacancy rates

Over-inflated prices

Strict landlord regulations

Economic instability

Owasso, Bixby, South Tulsa, and Broken Arrow remain especially strong for rentals.

Overall: Why Tulsa Stands Out Nationally

The comparison is clear:

Tulsa offers affordability, stability, opportunity, and value in a national housing landscape defined by uncertainty. Homebuyers and sellers benefit from a market that avoids extremes while still offering healthy growth year after year.

Inventory, New Listings, and Buyer Demand Patterns

Inventory levels—and the relationship between new listings and active buyer demand—are some of the strongest indicators of how the Tulsa real estate market 2025 is performing. While Tulsa’s market is not as constrained as many U.S. metros, it remains below ideal inventory levels in several key price ranges. Understanding how supply is entering (and leaving) the market is crucial for both buyers and sellers who want to set realistic expectations.

Where Inventory Stands Entering 2025

Inventory in the Tulsa metro has increased modestly compared to 2022–2023, but it still sits below a balanced level. While buyers have more choices than they did during the peak frenzy, there’s not enough inventory to eliminate competition—especially in certain price bands.

Current trends include:

Slight inventory gains in mid-range and luxury homes

Continued tightness under $300k

More new construction listings helping balance suburban demand

Homes needing updates sitting the longest

A return to faster turnover during spring and early summer

The market is healthier than the ultra-tight years of the pandemic, but it’s still far from oversupplied.

How New Listings Behave in 2025

New listings are entering the market at a steady but not overwhelming pace. However, velocity—how quickly listings go under contract—varies widely based on condition and price range.

Fast-moving new listings:

Updated homes under $400k

Homes in top school districts (Jenks, Bixby, BA, Owasso)

Renovated Midtown and Brookside homes

Move-in-ready homes in master-planned communities

Slower-moving listings:

Dated homes with deferred maintenance

Overpriced listings

Higher-end homes over $750k

Homes in less central or more rural areas

Many sellers are still adjusting to the reality that buyers in 2025 are choosier and more price-conscious.

Buyer Demand Patterns: What’s Driving Activity?

Demand in Tulsa real estate market 2025 is influenced by a blend of economic, demographic, and lifestyle factors. The buyer pool is strong and steady but behaves differently depending on the season, location, and price band.

1. First-Time Buyers

Strong demand continues under $300k.

These buyers often compete most aggressively and react quickly to well-priced homes.

2. Move-Up Buyers

This group is shaping mid-range demand, especially in newer suburban neighborhoods. Many families are moving for more space, newer finishes, or top-tier schools.

3. Relocators

One of the fastest-growing segments.

Tulsa’s affordability attracts buyers from:

Colorado

Texas

California

Washington

Illinois

Relocators frequently target Bixby, Jenks, Owasso, and South Tulsa for schools and new construction.

4. Investors

Still active, but more selective.

They target:

Under-$250k properties

Midtown bungalows

Homes needing cosmetic updates

Areas with strong rental demand like BA and Owasso

Investment activity remains healthy but not overheated.

Seasonal Inventory Trends Returning to Normal

After several unpredictable years, Tulsa’s seasonal patterns are beginning to normalize:

Spring (March–June)

Highest number of new listings

Strongest buyer demand

Fastest offers and highest sale prices

Prime season for families prioritizing school calendars

Summer (July–August)

Strong activity, especially move-up buyers

Slightly longer days on market

More selection in suburban neighborhoods

Fall (September–November)

More negotiability

Buyers focusing on value and condition

Great for sellers of well-maintained homes

Winter (December–February)

Fewer listings

Motivated buyers

Strong opportunity for sellers whose homes show well in quieter months

These cycles help predict competition and ideal listing timing.

Absorption Rates and What They Mean for 2025

Absorption rate measures how fast homes sell relative to how many are available. In 2025, Tulsa’s absorption rates vary:

Under $350k: High absorption, intense competition

$350k–$500k: Moderate absorption, balanced conditions

$500k–$750k: Steady but slower pace

$750k+: Lower absorption, buyer-driven market

This supports a hybrid market: competitive at the entry to mid-range, more negotiable at higher price points.

How Inventory Shapes Buyer & Seller Strategy

For buyers:

Expanded inventory in some price ranges means more time to evaluate choices.

In competitive areas, preparation and pre-approval are still essential.

Updated homes go fast—buyers must act quickly on the best listings.

For sellers:

Proper prep and pricing are crucial to stand out.

Homes must compete against both resale and new construction.

Launching during peak seasons boosts interest and potential offers.

Understanding inventory dynamics helps both sides navigate the market more effectively.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Investment Outlook: Is Tulsa Still a Good Market for Investors?

Tulsa continues to attract both local and out-of-state investors thanks to its strong rental demand, stable appreciation, and lower entry prices compared to national averages. In the Tulsa real estate market 2025, investors benefit from a unique combination of affordability, job growth, and population stability—factors that support long-term returns even as interest rates fluctuate. While some investor-heavy markets across the U.S. have cooled or corrected, Tulsa remains consistently appealing for buy-and-hold strategies, mid-term rentals, and specific short-term rental pockets.

Why Tulsa Stands Out for Investors in 2025

Tulsa’s appeal is rooted in fundamentals that have stayed strong for years:

Affordable entry prices compared to most U.S. metros

Strong, stable rental demand from families, students, and relocators

Consistent appreciation without volatile spikes

Job stability in aerospace, healthcare, tech, manufacturing, and energy

Reasonable property taxes and insurance rates

Growing corporate relocation activity

Many investors who struggled to generate returns in markets like Austin, Boise, Phoenix, or parts of California find Tulsa more predictable and less risky for long-term cash flow.

Best Types of Investment Properties in Tulsa Right Now

Single-Family Rentals (SFRs)

Single-family homes—especially under $300,000—remain the best-performing investment type due to ongoing rental demand from families.

Top-performing areas include:

Broken Arrow

Owasso

Midtown Tulsa (bungalows and cottages)

East Tulsa

Certain pockets of South Tulsa

SFRs are appealing because they attract stable tenants, reduce turnover, and tend to appreciate well.

Mid-Term Rentals (Corporate or Travel Nurse Housing)

Mid-term rentals (MTRs)—typically 30+ day furnished stays—continue growing in popularity for:

Travel nurses

Medical professionals

Corporate relocations

Families renovating their current homes

Insurance displacement stays

Tulsa’s medical and corporate sectors make this strategy particularly strong. Owasso, South Tulsa, Midtown, and Broken Arrow see consistent activity.

Small Multifamily (Duplex, Triplex, Fourplex)

Although limited in supply, small multifamily properties offer excellent occupancy and reliable cash flow.

Areas showing consistent performance include:

Midtown and East Tulsa

Near TU (University of Tulsa)

Older established neighborhoods with rental history

Investors must act quickly—these properties rarely stay on the market long.

Select Short-Term Rentals (STRs)

While STR regulations vary across the U.S., Tulsa remains relatively friendly to short-term rentals. Not every neighborhood is ideal, but STRs perform well when:

Located near downtown, Gathering Place, Brookside, or Cherry Street

Offering unique amenities or design

Positioned near hospitals or event venues

Not competing with dense new construction zones

Tulsa’s STR occupancy remains healthy, though more competitive than in previous years.

Cash Flow Expectations in 2025

Because Tulsa remains an affordability-driven market, investors can still find properties that cash flow—something increasingly rare in major metros.

Typical ranges:

Entry-level SFRs: modest but stable cash flow

Mid-tier homes: stronger appreciation with moderate cash flow

Multifamily: the best cap rates but limited availability

MTR/STR properties: highest gross returns with more active management

While interest rates affect monthly returns, rents have continued to rise gradually, supporting overall profitability.

Rental Demand Remains Strong Across Most Suburbs

Demand for rentals in Tulsa is fueled by:

Young professionals seeking flexibility

Families not ready to buy

Individuals relocating for job opportunities

College and graduate students

Medical professionals

Corporate relocations

Top rental demand areas in 2025:

Broken Arrow

Owasso

Midtown Tulsa

Bixby

South Tulsa

This widespread demand supports consistent occupancy and long-term stability.

Appreciation Trends: Slow, Steady, and Reliable

Tulsa’s appreciation is not explosive—but it’s reliable. Over the long term, the market has consistently outperformed inflation while avoiding bubbles.

Investors benefit from:

Predictable appreciation

Lower volatility

Balanced growth between suburban new construction and older central neighborhoods

This makes Tulsa especially appealing for long-term hold strategies.

Risks Investors Should Watch in 2025

No market is risk-free. Key considerations for Tulsa include:

Higher interest rates compressing cash flow

Competition with new construction in suburban areas

Limited small multifamily inventory

Tenant quality screening in certain neighborhoods

Increasing maintenance costs for older homes in Midtown and East Tulsa

Investors who understand micro-markets and pricing trends can navigate these risks effectively.

You might also like reading about Tulsa Neighborhoods & Lifestyle, which breaks down which areas attract renters, families, and relocators.

So—Is Tulsa Still a Good Investment Market in 2025?

Yes. Tulsa remains one of the most stable and opportunity-rich markets in the Midwest.

Investors benefit from:

Accessible entry prices

Strong rental demand

Predictable appreciation

Expanding job sectors

Reliable long-term return potential

Whether purchasing a single-family rental, a mid-term rental, a small multifamily, or the right short-term rental, investors in the Tulsa metro continue to find opportunities that are increasingly rare elsewhere in the country.

Relocation Trends: Who’s Moving to Tulsa & Why

Relocation continues to be one of the strongest forces shaping the Tulsa real estate market 2025. As affordability challenges grow in major metros across the U.S., Tulsa stands out as a city where buyers can still find spacious homes, strong schools, thriving job opportunities, and a lifestyle that balances convenience, culture, and community. The result is a steady flow of newcomers—young professionals, families, retirees, and remote workers—who are choosing Tulsa over more expensive, more crowded markets.

Where New Tulsa Residents Are Coming From

People are moving to Tulsa from a wide range of states and for many different reasons, but the most common patterns include:

1. High-Cost States

Relocators fleeing skyrocketing home prices and property taxes often come from:

California

Colorado

Washington

Oregon

Illinois

New York

These buyers are especially drawn to Tulsa’s affordability and quality of life. Many can purchase larger, newer homes here for a fraction of their previous housing costs.

2. Regional Moves

Nearby states also contribute heavily to Tulsa migration:

Texas

Arkansas

Missouri

Kansas

These moves are often motivated by job transitions, family proximity, or the desire for a lower cost of living.

3. Internal Oklahoma Migration

People move from smaller Oklahoma towns to Tulsa for:

Career growth

Education

Healthcare access

Urban amenities paired with suburban living

This creates a healthy internal migration pattern that strengthens the metro area long-term.

Why People Are Choosing Tulsa in 2025

Affordability

The number one reason people relocate to Tulsa is simple: they can afford a better life here.

Lower home prices, lower taxes, and manageable utility costs make Tulsa especially appealing for first-time buyers, families, and retirees.

Job Opportunities & Economic Stability

Tulsa’s job market continues to diversify, offering growth in:

Aerospace

Energy & manufacturing

Healthcare

Engineering

Technology

Education

Major employers and ongoing investment in infrastructure make Tulsa an attractive long-term choice.

School District Strength

Suburbs such as:

Jenks

Bixby

Broken Arrow

Owasso

attract many families relocating specifically for education.

Lifestyle & Amenities

Tulsa offers a surprising blend of metropolitan amenities and small-city comfort:

The Gathering Place

Downtown Arts District

BOK Center events

River Parks trails

Local dining, breweries, and festivals

Family-friendly suburbs

Affordable lake access within 45–90 minutes

This lifestyle mix is one of the strongest relocation drivers in 2025.

Remote Work Flexibility

People who no longer need to commute daily choose Tulsa because it offers more space, quieter neighborhoods, and lower living costs while still providing high-speed internet and strong community amenities.

Most Popular Areas for Relocating Buyers

Relocators tend to gravitate toward neighborhoods offering newer homes, good schools, and convenient commutes.

Top suburbs for relocators:

Bixby – Newer construction, excellent schools, family appeal

Jenks – Competitive market with top-tier schools

Broken Arrow – Wide price range and strong amenities

Owasso – Consistent growth and major retail conveniences

South Tulsa – Established neighborhoods near dining and employers

Midtown Tulsa – Loved for charm, walkability, and culture

Each of these areas offers something unique, which is why they appear frequently in relocation searches.

Housing Preferences of Relocators

Relocators often shop differently than local buyers. Common preferences include:

Turnkey, move-in-ready homes

New construction with warranties

Homes with office or flex spaces

Larger yards or outdoor living areas

Three-car garages

Proximity to strong schools or major employers

Because relocators often have more flexible budgets—especially when coming from high-cost states—they shape pricing trends in several key suburbs.

How Relocation Shapes the Tulsa Real Estate Market

Relocation has become a major reason Tulsa remains steady and competitive. These buyers:

Support home values even during slower seasons

Increase demand for new construction

Strengthen the mid-range market ($350k–$500k)

Help stabilize luxury demand in select areas

Keep rental demand strong for corporate or transitional housing

As long as Tulsa remains significantly more affordable than other metros, relocation will continue to shape demand in meaningful ways.

You might also like reading about Relocation & Moving to Tulsa, which offers a full breakdown of neighborhoods, schools, and lifestyle factors.

Seasonal Insights: What Part of the Year Is Best to Buy or Sell?

Seasonality has always influenced the Tulsa real estate market, but in 2025 these patterns have returned to a more predictable rhythm after several years of post-pandemic volatility. Buyers and sellers who understand how timing affects competition, pricing, inventory levels, and buyer motivation will have a measurable advantage. While homes sell year-round in Tulsa, certain months consistently outperform others—and different buyer groups behave uniquely depending on the season.

Why Seasonal Patterns Matter in the Tulsa Real Estate Market

Seasonality affects nearly every major factor in the buying and selling process:

Inventory supply

Buyer demand and urgency

Showing traffic

Days on market

Competitive pressure

Seller concessions

Timing for school-year transitions

Weather-related moveability

Understanding these patterns allows buyers to choose the most advantageous time to act and helps sellers position their listings for maximum visibility.

Season-by-Season Breakdown

Spring (March – June): The Peak Season

Spring is the strongest, fastest-moving season for Tulsa real estate.

This is when the majority of families, relocators, and move-up buyers are active.

What Spring Means for Sellers

Highest buyer traffic

Shortest days on market

Best chance for multiple offers

Strongest demand for turnkey, updated homes

Higher pricing tolerance if the home shows well

Updated homes in Jenks, Bixby, Broken Arrow, Midtown, and Owasso often sell within days—sometimes within hours—during spring.

What Spring Means for Buyers

More inventory to choose from

Strong competition, especially under $400k

Fewer concessions available

Faster decision-making required

Pre-approval is essential

Spanish Cove-like neighborhoods, planned communities, and top school districts see the most movement.

Summer (June – August): Still Strong, but Slightly More Balanced

The first part of summer remains competitive, especially for families needing to settle before school starts. However, by mid-summer, the market becomes slightly less frenetic.

What Summer Means for Sellers

Good time to list family-friendly homes

Larger homes with yards perform particularly well

Some price resistance as buyers fatigue from spring competition

Homes that launched too high in the spring may need price adjustments by July.

What Summer Means for Buyers

More inventory carries over from spring

Better negotiability than in March–May

Inspections and repairs more commonly requested and honored

Homes needing cosmetic updates become more attractive for budget-conscious shoppers

Suburban new construction sees strong summer activity as families coordinate moving timelines.

Fall (September – November): The Season of Value & Negotiation

Fall is one of the most underrated seasons in the Tulsa market.

While buyer activity is lower, the buyers who are active tend to be serious, motivated, and financially prepared.

What Fall Means for Sellers

Fewer competing listings

Strong opportunity for well-prepared homes

Pricing must reflect cooling seasonal demand

Homes with good curb appeal (fall colors, tidy landscaping) make a strong impact

Move-up and downsizing buyers are especially active in early fall.

What Fall Means for Buyers

Less competition

More room for negotiation

Increased likelihood of seller concessions

Favorable conditions for long-close or flexible-close contracts

Buyers who don’t need to move on a school schedule often find the best deals in fall.

Winter (December – February): Motivated Buyers, Motivated Sellers

Winter is slower in terms of volume, but not necessarily in results. Serious buyers—relocators, investors, corporate transfers, downsizers, and first-time buyers tired of renting—remain active.

What Winter Means for Sellers

Lower showing activity overall

Highly motivated buyer pool

Best opportunity for homes that show well in colder months

Less competition from other listings

Homes with cozy interiors, fresh paint, and good lighting show exceptionally well in winter.

What Winter Means for Buyers

More negotiable sellers

Higher chance of price reductions

Slower-moving market means more time to make decisions

Builders often offer aggressive year-end incentives

Winter is often the most favorable season for buyers needing closing cost help or rate buydowns.

When Is the Best Time to Buy in Tulsa?

Fall and winter offer the most negotiability and best pricing opportunities.

Spring offers the most selection but also the stiffest competition.

Best Time for Buyers By Motivation:

First-time buyers: Fall and winter

Move-up buyers: Spring and early summer

Relocators: Year-round, depending on job timelines

Investors: Winter (price reductions) or early spring (strong rental demand projections)

When Is the Best Time to Sell in Tulsa?

March through June is the strongest window, especially for:

Family homes

Updated suburban properties

Homes in Jenks, Bixby, BA, Owasso, Midtown

Move-in-ready listings under $450k

Homes that need updates or repairs may benefit from launching in fall or winter when competition is lower.

How Interest Rates Interact With Seasonality in 2025

The usual seasonal patterns can be affected by rate shifts:

If rates dip, buyer activity surges immediately—even outside peak seasons.

If rates rise, updated and well-priced homes continue to outperform others.

If rates stabilize, traditional seasonal rhythms become even more pronounced.

In 2025, stabilization is making seasonal patterns clearer and more predictable.

What This Means for You: Buyers, Sellers, Move-Up Buyers, and Downsizers

The Tulsa real estate market 2025 is balanced, stable, and opportunity-driven—but the opportunities look different depending on who you are and what your goals are. Whether you’re buying your first home, moving up to your next one, preparing to sell, or considering a downsize, understanding how current pricing, interest rates, inventory levels, and demand patterns affect your plans will help you make confident decisions in 2025.

For Buyers: Opportunity With Preparation

Buying in 2025 requires strategy but offers meaningful advantages—especially compared to the peak years when bidding wars were the norm.

Key Advantages for Buyers

Slightly increased inventory in many price ranges

More negotiability on repairs and concessions

Builder incentives in new construction (rate buydowns, closing costs)

Slower pace in certain seasons (fall and winter)

Continued affordability compared to national markets

Key Considerations

Updated homes under $350k still move quickly

Pre-approval is essential—preferably full underwriting

Comparing new construction incentives vs. resale pricing is crucial

Buyers relocating from higher-priced states often have competitive budgets

Buyers who enter the market prepared, realistic, and ready to act will find strong opportunities throughout the year.

For Sellers: Strong Demand—But Strategy Matters

Sellers still benefit from higher-than-normal demand, particularly in suburbs with strong school districts and neighborhoods with updated, move-in-ready homes.

Strengths for Sellers in 2025

Tulsa remains a slight seller’s market

Strong demand in Jenks, Bixby, Broken Arrow, Owasso, and South Tulsa

Homes under $400k attract immediate attention

Relocators provide steady demand year-round

What Sellers Must Get Right

Pricing: Strategic pricing is more important than ever

Condition: Updated homes sell significantly faster

Presentation: Clean, staged, and neutral sells best

Timing: Spring offers the fastest sales; winter attracts motivated buyers

Sellers who adapt to 2025’s more balanced conditions can still achieve excellent results—and often faster than expected.

For Move-Up Buyers: One of the Best Markets in Years

Move-up buyers (those selling a current home to buy a larger or newer one) benefit uniquely in 2025.

Why Move-Up Buyers Have an Advantage

Strong demand for entry-level and mid-tier homes makes selling easier

More choices exist in the $350k–$600k range

New construction options are plentiful

Negotiability is often greater at higher price points

Trade-up buys are smoother due to more balanced inventory

Challenges to Plan For

Coordinating the sell-and-buy timeline

Planning for temporary housing if needed

Managing the emotional and logistical complexity of two transactions

Internal link suggestion: You might also like reading the Move-Up Buyer Guide for full timelines and strategies.

For Downsizers: A Lifestyle-Driven Market With Options

Downsizers play a significant role in Tulsa’s 2025 activity, often transitioning from larger suburban homes into something lower-maintenance, more manageable, or closer to amenities.

Why Downsizing Works Well in 2025

Demand remains high for well-maintained larger homes

Downsizers often benefit from strong equity positions

More single-story new builds and smaller luxury homes are available

Suburban communities offer HOA-managed and low-maintenance living options

Considerations for Downsizers

Timing sales to peak seasons may maximize equity

Identifying must-have vs. nice-to-have features in a new home

Planning for moving logistics, decluttering, or estate prep

Considering proximity to family, healthcare, and daily conveniences

Downsizing remains a strong and practical strategy for many Tulsa homeowners.

The Big Picture: What 2025 Means for All Homeowners and Buyers

Across all buyer and seller types, 2025 offers a market defined by:

Stability instead of unpredictability

Opportunity instead of frenzy

Strategy instead of urgency

Balance instead of competition-only dynamics

Buyers gain negotiability.

Sellers capture steady demand.

Move-up buyers have one of the best playing fields in years.

Downsizers find lifestyle-driven solutions without market pressure.

In every case, understanding Tulsa’s micro-markets—Jenks vs. Bixby, Midtown vs. South Tulsa, East BA vs. North Owasso—is essential for optimizing results.

Final Thoughts on the Tulsa Real Estate Market 2025

The Tulsa real estate market 2025 is defined by stability, steady demand, and a sense of balance that many other U.S. markets simply don’t have right now. While national headlines focus on volatility, affordability crises, and dramatic price swings, Tulsa continues to move at a sustainable pace—supported by strong local fundamentals, consistent job growth, and a wide range of buyers who see long-term value in the metro.

For buyers, the path forward is clearer than it has been in years. Inventory is modestly improving, competition is more manageable, and negotiability is returning, especially outside the lowest price ranges. Whether you’re a first-time buyer looking for affordability, a move-up buyer targeting a new construction home, or a relocating family drawn by Tulsa’s schools and lifestyle, 2025 offers real opportunity with the right preparation.

Suggested Image Here: A wide, warm, realistic photo of a Tulsa neighborhood at sunset—tree-lined streets, tidy homes, and soft golden lighting to symbolize optimism and stability.

For sellers, the fundamentals remain strong. Updated, well-presented homes continue to command attention, and suburban markets with strong schools are performing exceptionally well. Pricing strategy matters, presentation matters, and timing matters—but sellers who approach 2025 with intention are still achieving excellent results.

For investors, Tulsa continues to outperform many metros suffering from oversaturation or affordability issues. Steady rent demand, reasonable acquisition costs, and predictable appreciation continue to make Tulsa a dependable long-term market.

Ultimately, 2025 is a year defined not by extremes, but by opportunity—rooted in understanding how local conditions intersect with your personal goals. Whether you’re buying, selling, investing, or transitioning into a new stage of homeownership, the key to success is navigating Tulsa’s micro-markets with clarity, data, and a strong sense of where the market is headed.

If you’re planning a move in 2025—whether buying your first home, moving up, downsizing, or relocating—I’d love to help you navigate the Tulsa market with confidence. Working with a local real estate agent who understands neighborhood-level trends, pricing nuances, and market timing can make all the difference. When you’re ready to talk about your next steps, feel free to reach out anytime.

Share this post: on Twitter on Facebook