Losing a loved one is one of the most difficult experiences anyone can go through. Between the grief, the funeral arrangements, and the sudden influx of family members, it is easy to feel completely overwhelmed. If you have been named the executor or personal representative of an estate in Tulsa, that emotional weight is often compounded by a heavy administrative burden. You might be asking yourself, “Where do I even start?” or “What am I legally allowed to touch right now?”

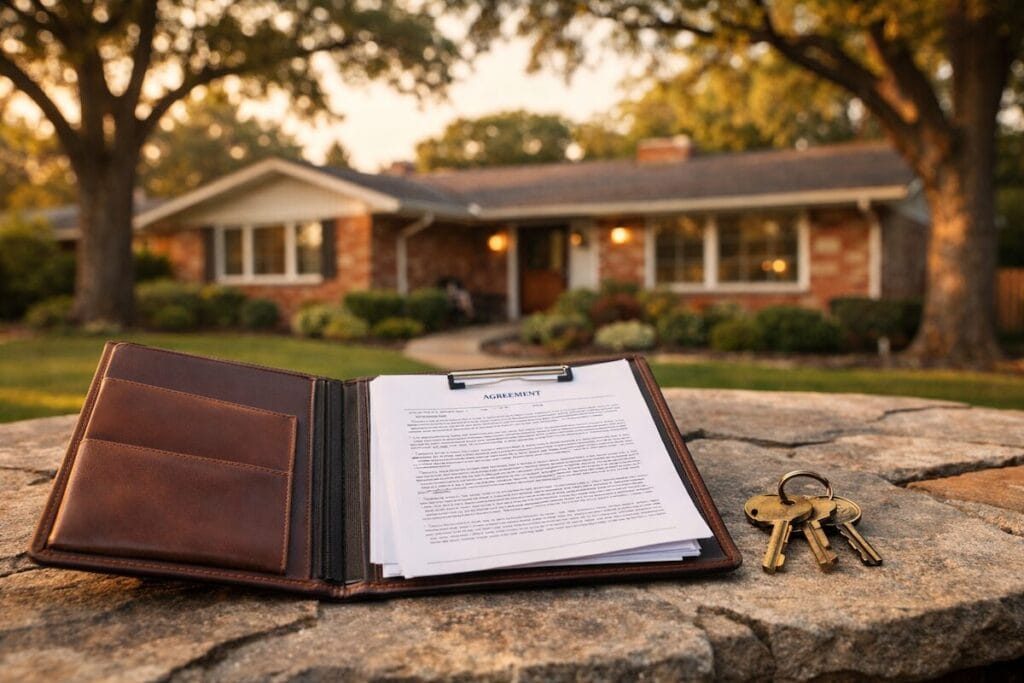

Please know that you are not alone in this process. Many people in Tulsa County find themselves in this exact position every year, staring at a stack of mail and a set of house keys, unsure of what to do next. As a local real estate professional who has lived in Broken Arrow since 1995, I have walked alongside many families during this transition. I have learned that the first month is critical. The actions you take—or fail to take—in those first 30 days can significantly impact how smooth the rest of the probate process will be.

This article serves as your initial Tulsa Probate Guide, designed to cut through the confusion and give you a clear, actionable checklist. We aren’t going to worry about the final distribution of assets or closing the estate yet. Right now, we just need to focus on securing the legacy your loved one left behind. From changing the locks to understanding Oklahoma’s specific insurance rules for vacant homes, we will cover the immediate “triage” steps you need to take to protect the estate’s value. Take a deep breath. We are going to take this one step at a time.

Wait—Is the House in a Trust? Before you dive into this list, check the deed to the house or the estate planning binder. Does it say the owner is “The John Doe Revocable Living Trust”?

If so, take a breath of relief.

Homes held in a Trust typically do not have to go through the lengthy probate court process described in Step 2. As the Successor Trustee, you likely have the immediate authority to manage the home without waiting for a judge to appoint you.

However, do not stop reading. While you get to skip the court filings in Step 2, the practical “boots on the ground” work remains exactly the same. Steps 1, 3, 4, and 5 apply to you 100%. You still need to secure the property, notify the utilities, get the proper insurance, and assemble your local support team.

1. Secure the Property and Physical Assets Immediately

The very first thing you must do, often before the funeral even takes place, is to secure the physical assets. This sounds harsh to some, but it is a necessary step to protect the inheritance for all heirs involved. In the confusion following a death, it is unfortunately common for well-meaning relatives, neighbors, or even people with bad intentions to enter the home. They might feel entitled to “borrow” a piece of furniture, look for a specific memento, or “clean up.”

However, as the future executor, it is your responsibility to ensure that nothing leaves the house until it has been properly inventoried. If an expensive tool set, a collection of jewelry, or even the family car goes missing during this window, you could be held liable by the probate court later. You need to physically secure the premises. This usually means changing the locks on all exterior doors immediately. Do not rely on the existing keys, as you have no way of knowing who has a spare copy—neighbors, dog walkers, or distant relatives might still have access.

Find a trusted locksmith in Tulsa to re-key the home. This is a small expense that the estate can reimburse you for later, but it provides immediate peace of mind. Additionally, check all window latches and garage door openers. If the home has a security system, contact the provider to reset the code. If the property is in a more rural part of Tulsa County or Wagoner County, you may also need to physically check outbuildings or barns to ensure equipment is secure.

Finally, do not forget about the perishables and the pets. If there is a pet in the home, finding them immediate foster care with a family member is a priority. For the house itself, go to the refrigerator and remove any food that will spoil. If the home is going to sit empty for weeks while you wait for court appointments, a fridge full of rotting food is a disaster you do not want to clean up later. Walk through the home, turn off unnecessary electronics, and adjust the thermostat to a setting that prevents winter pipe bursts or summer humidity damage, while keeping utility bills reasonable.

2. File the Will and Petition for Letters Testamentary

Once the immediate physical security is handled, you must turn your attention to the legal side of things. In Oklahoma, you cannot legally act as the executor until the court says you are the executor. Just because the Will names you as the personal representative does not mean you have the legal authority to sign contracts, access bank accounts, or sell real estate yet. You need a document called “Letters Testamentary” (if there is a Will) or “Letters of Administration” (if there is no Will).

To get this, you need to file a petition with the Tulsa County District Court (or the county where the deceased lived). Contact a reputable estate planning attorney to help you with this filing. While it is possible to handle some legal matters on your own, probate is complex. A simple mistake in the filing paperwork can delay your authority by weeks or even months. During that delay, the bills keep coming, and the property taxes keep accruing.

The court process begins by filing the original Will and a petition to open probate. A hearing date will be set, usually a few weeks out, where the judge will officially appoint you. It is only after this hearing that you receive your Letters. This official document is your “badge of authority.” You will need certified copies of these Letters for almost everything you do moving forward: dealing with the bank, talking to the mortgage company, and eventually hiring a real estate agent to sell the home.

Many people mistakenly believe that having a Power of Attorney (POA) allows them to handle these matters. It is crucial to understand that a Power of Attorney expires upon the person’s death. It is no longer valid. The only way to get legal authority now is through the probate court. Do not try to use an old POA to withdraw money or sign documents, as this can lead to serious legal trouble. Start the court process as early as possible because the Tulsa estate administration timeline can be slow, and you want to get that clock ticking.

Download our probate timeline checklist (link to a probate timeline lead magnet or PDF) to see exactly what the next 12 months might look like.

3. Notify the Necessary Parties and Protect the Data

While you are waiting for your court date, you can start the process of notifying everyone who has a stake in the estate or a relationship with the deceased. Most people remember to call the family and the funeral home, but the list of necessary notifications is actually much longer. You need to think about the practical services that keep the household running.

Start with the utility companies. In the Tulsa area, this usually means calling Public Service Company of Oklahoma (PSO), Oklahoma Natural Gas (ONG), water and cable/internet. You do not necessarily want to shut these services off—especially if you plan to sell the home, as you will need lights and climate control for showings—but you do need to notify them that the account holder has passed. Eventually, these accounts will need to be transferred to the estate’s name or your name as the administrator.

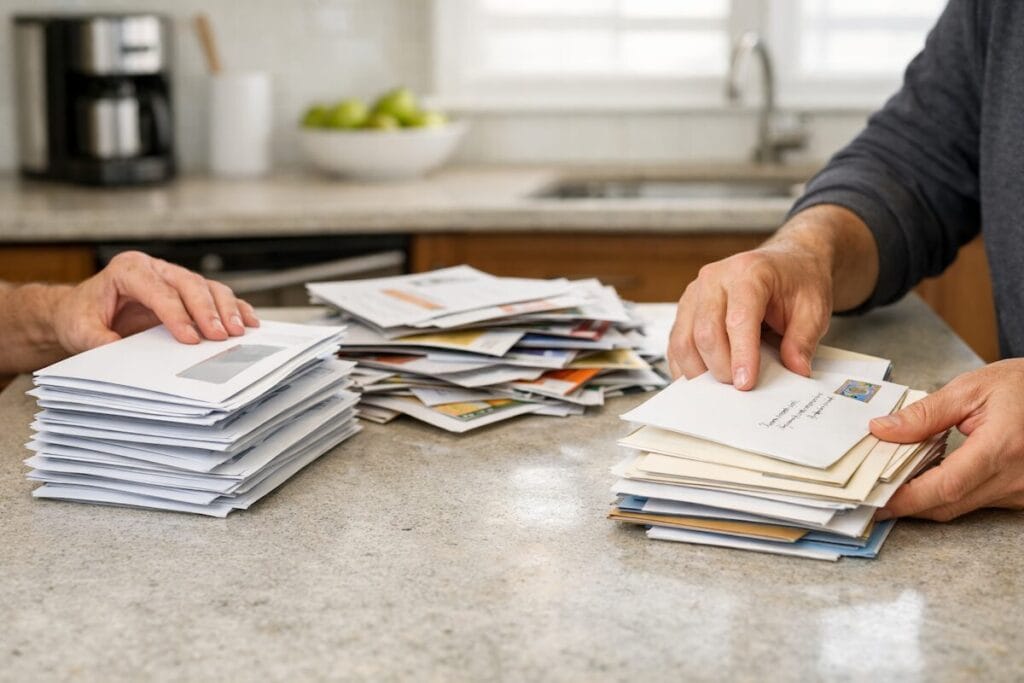

Next, address the mail. Identity theft of deceased persons is a real and growing crime. Thieves watch obituaries and then check mailboxes for bank statements, credit card offers, or checks. Go to the post office or visit the USPS website and submit a request to forward all mail to your address. This serves two purposes: it protects the deceased’s identity, and it helps you discover assets and debts you might not know about. You will likely start receiving bills, subscription renewals, and bank statements that will help you build the inventory later.

You should also look into your loved one’s digital life. If you have access to their email or computer, look for recurring subscriptions that need to be canceled. Streaming services, gym memberships, and monthly donation drafts can drain a bank account quickly if left unchecked. If they were still working, contact their employer’s HR department to inquire about final paychecks, work-provided life insurance, or 401(k) information. These are estate assets that need to be tracked down.

Finally, you must notify potential creditors. This is a formal part of the executor duties in Oklahoma, usually handled by your attorney publishing a notice in a local newspaper. However, if you know of specific debts—like a mortgage or a car loan—it is wise to call those lenders sooner rather than later. Let them know the borrower has passed and that you are opening probate. Most lenders have a dedicated department for this and will place a temporary hold on late fees or collection calls while the legal process is sorted out.

4. Address the “Vacant Home” Insurance Issue

This is one of the most overlooked risks in the entire probate process, and it can cost the estate hundreds of thousands of dollars. Most homeowners’ insurance policies have a “vacancy clause.” This clause typically states that if a home is uninhabited for more than 30 (sometimes 60) days, coverage is significantly reduced or may be voided altogether.

Standard policies are written for occupied homes where someone is there to catch a leaking pipe, put out a small kitchen fire, or deter vandals. When a house sits empty, the risk profile skyrockets. If a pipe bursts in an empty house in Midtown Tulsa and runs for three weeks before anyone notices, the damage is catastrophic. Because of this extra risk, the insurance company needs to know the house is vacant. If you fail to notify them and a claim occurs after that 30-day window, they may deny the claim in its entirety.

You need to contact the deceased’s insurance agent immediately. Ask them specifically: “What is the timeline for vacancy on this policy?” and “Do we need to switch to a vacancy policy or purchase a vacancy endorsement?” Get a quote for vacant home insurance if the current carrier cannot cover it. Yes, vacant home insurance is often more expensive than a standard policy, but it is a necessary expense. It protects the estate’s single most valuable asset.

Furthermore, you need to ensure the premiums are paid. If the deceased paid their insurance through an escrow account attached to their mortgage, and you stop paying the mortgage because the bank accounts are frozen, the insurance could lapse. Check the policy status immediately. If the policy is about to expire or is being canceled for non-payment, you may need to pay the premium out of pocket (and get reimbursed later) to keep the coverage active. Do not let the house go uninsured for even a single day.

5. Assemble Your “Boots on the Ground” Team

Being an executor is a job. It is a project management role that requires you to coordinate legal, financial, and physical tasks. You cannot—and should not—do it all yourself. Trying to clean out a 30-year-old home, handle the legal filings, maintain the lawn, and sell the property all on your own is a recipe for burnout. In these first 30 days, your goal should be to assemble a team of local professionals who can help you carry the load.

You likely already have an attorney to help with the legal paperwork. But you also need to think about the physical house. Who is going to mow the lawn? Tulsa code enforcement is strict about tall grass, and nothing screams “vacant house” like an overgrown yard. Find a reliable lawn service (link to a local landscaper or maintenance vendor) to put on a bi-weekly schedule.

You will also likely need an estate sale company. Do not start throwing things away or donating items until you have had a professional look at the contents of the home. What looks like “junk” to you might be a valuable collectible. A reputable Tulsa estate sale company can come in, organize the belongings, price them, and run a sale that clears out the house while maximizing the return for the heirs. Booking these companies can take time, so making contact in the first month is smart.

Perhaps most importantly, you need a real estate agent who understands probate. Selling a probate home is different from a standard transaction. There are specific contract disclosures required, court timelines to respect, and often “as-is” conditions to negotiate. You need a partner who can help you determine if the house should be sold in its current condition to an investor or if it is worth doing minor repairs to list it on the open market for a higher price.

Start your Tulsa home valuation (link to home value page) to get a baseline idea of what the property is worth in today’s market. This information will be helpful when you fill out your inventory for the court. A knowledgeable agent can also connect you with all the other vendors you need—cleaners, painters, and contractors—saving you hours of research.

Tulsa Probate Guide: 3 Critical Mistakes to Avoid

While knowing what to do is important, knowing what not to do can be just as valuable. In my years serving the Tulsa estate administration market, I have seen well-intentioned executors make errors in the first few weeks that later caused legal headaches for months. The probate process is highly regulated, and stepping outside the lines—even accidentally—can expose you to personal liability.

The most common mistake I see is premature asset distribution. It is natural to want to let family members “come over and pick a few things” to remember Mom or Dad by. Perhaps your sister wants the dining room table, or your nephew was promised the tools in the garage. However, until you have official authority (Letters Testamentary or Trustee status) and a full inventory has been completed, giving away items is risky. If the estate turns out to have more debts than assets, those items might legally need to be sold to pay creditors. If you have already given them away, you might have to ask family members to return them, which is a recipe for conflict.

Another major pitfall is commingling funds. This happens when an executor uses their own personal checking account to pay for estate expenses, or worse, deposits estate checks into their personal account “just for safekeeping.” This is a big no-no. The estate is a separate legal entity. You need to open a dedicated estate bank account (using the tax ID number you will get from the IRS) and keep every single penny separate. If you pay for the funeral or the vacant home insurance out of your own pocket, keep a meticulous receipt trail. Reimbursement is allowed, but commingling is not.

Finally, do not underestimate the emotional toll this role takes. Many executors try to sprint through the process, thinking they can wrap everything up in a few weeks and get back to their normal lives. Realistically, probate in Tulsa County can take 6 months to a year. If you burn yourself out in the first 30 days trying to do everything alone, you won’t have the energy for the marathon ahead. Pace yourself. Lean on your team of professionals.

Schedule a low-pressure planning call so we can help you map out a realistic timeline that protects your sanity.

Managing Family Expectations and Communication

Technically, your duty as an executor is to the court and the estate’s beneficiaries. But practically, your job is also “Chief Communicator.” In the vacuum of information, family members often create their own narratives. If siblings or heirs don’t hear from you, they may assume nothing is happening—or worse, that you are hiding something. This is where many disputes begin, not over money, but over a lack of transparency.

In the first 30 days, establish a clear communication method. You do not want to be fielding text messages from five different cousins at all hours of the day asking, “When is the house being sold?” or “When do we get our inheritance?” Instead, set a precedent early. Tell the family, “I will be sending out an email update every Friday to let everyone know what was accomplished this week and what is on the docket for next week.”

This proactive approach puts you in control. It reassures the beneficiaries that you are actively working on the executor duties in Oklahoma without requiring you to be “on call” 24/7. In your updates, be honest about the delays. If the court date got pushed back, tell them. If the house needs a new roof before it can be listed, explain why that expense is necessary to preserve the equity. Transparency builds trust, and trust is the currency you need to get through probate without destroying family relationships.

If the house is the main point of contention—as it often is—having a neutral third party involved can diffuse the tension. When family members disagree on the value of the property, they often view the executor’s opinion as biased. This is where a professional market analysis helps. It’s not your opinion on the price; it’s the data-backed assessment of a real estate professional.

Check your home’s value to get a neutral, third-party starting point for these family discussions.

Frequently Asked Questions (FAQ)

Can I change the locks on the house before probate is officially opened? Yes, in fact, you arguably have a duty to do so to protect the assets. While you may not yet have the legal authority to sell the home, securing the property is considered a preservation act. If you do not change the locks and someone with a key steals items, you could be questioned for failing to secure the estate. Keep the locksmith receipt, as this is a valid expense to be reimbursed by the estate once the funds are available.

What happens if the mortgage isn’t paid while we wait for the court appointment? This is a very common stressor. Banks are generally forbidden from foreclosing immediately after a borrower’s death, provided they are notified. You should contact the lender’s “Successor in Interest” department immediately. They will usually grant a grace period or allow you to defer payments for a few months while the legal administration gets set up. However, interest will continue to accrue. Once the estate bank account is open, catching up on these payments is typically a priority.

Do I have to use the attorney who wrote the Will to handle the probate? No, you are not legally required to use the attorney who drafted the original estate plan. You are free to hire any Oklahoma-licensed attorney who specializes in probate. It is often helpful to interview a couple of attorneys to find one whose communication style matches yours. The same applies to real estate agents; you are not obligated to use the agent your parents used 20 years ago. You need a partner who understands the current Tulsa market and the specific nuances of probate sales.

Can I sell the personal items in the house to pay for the funeral? Proceed with extreme caution here. Generally, you should not sell anything until you have your Letters Testamentary and have filed an inventory with the court. However, there are some exceptions for “perishable” property or if the estate has no cash and immediate debts (like a funeral) must be paid. Before you sell a single item, consult your probate attorney. If you sell items too early or for less than they are worth, you could be personally liable to the other heirs for the difference.

How long does the whole process take in Tulsa County? While every case is unique, a standard, uncontested probate in Tulsa typically takes at least 6 months due to statutory waiting periods for creditors. If there are complications—such as a missing heir, a contested Will, or a property that is difficult to sell—it can easily stretch to 9-12 months or longer. The “first 30 days” we discussed in this article are just the warm-up lap. This is why building a sustainable system and a strong team is so vital.

Conclusion

The first month of being an executor is often a blur of grief and paperwork. It feels like you are drinking from a firehose, trying to learn legal terms while planning a memorial service. But by focusing on these five core priorities—securing the property, filing the legal paperwork, managing notifications, obtaining the right insurance, and building your team—you are laying a solid foundation for the months ahead.

You do not have to have all the answers today. You just need to take the next right step. Whether that is calling a locksmith to secure the Broken Arrow family home or interviewing an attorney to file the petition, action is the antidote to overwhelm.

I have helped countless Tulsa families navigate this journey, often serving as the bridge between the legal requirements and the practical reality of clearing out a home full of memories. If you are feeling stuck or just need a recommendation for a trustworthy estate sale company, I am here to be a resource. You don’t have to do this alone.

Get the Tulsa first-time executor guide (link to buyer/seller guide page or specific lead magnet) for a printable version of this checklist to keep on your desk.