The Tulsa housing market in October 2025 remains steady and balanced, offering opportunities for both buyers and sellers. While home prices have eased slightly from summer peaks, overall demand is consistent — particularly for updated, move-in-ready homes.

According to October MLS data:

| Metric | Tulsa County | Entire MLS |

|---|---|---|

| Average Sales Price | $337,041 | $314,449 |

| Average Days on Market (DOM) | 56 | 67 |

| New Listings (vs. September) | 1,029 (↑ from 962) | 2,420 (↑ from 2,364) |

| Closed Sales | 602 | 1,366 |

| Inventory / Months of Supply | 3.2 | 4.2 |

| List-to-Sale Price Ratio | 96% | 94.8% |

These figures show a healthy, moderately competitive market that rewards well-prepared sellers while giving buyers more flexibility in negotiations.

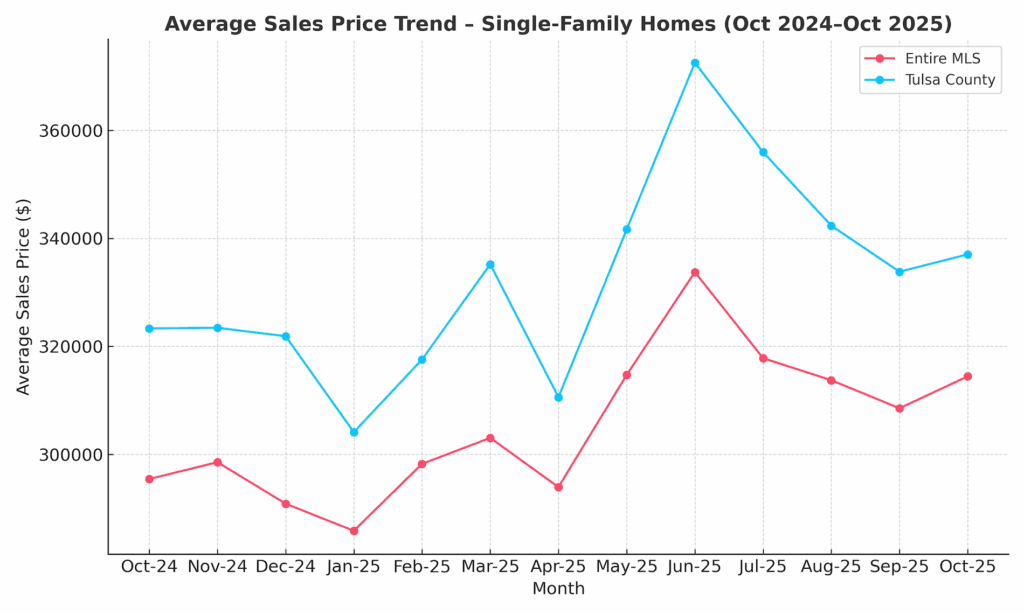

Average Home Prices Hold Steady

After a lively summer, home prices across the Tulsa housing market have stabilized but remain well above 2024 levels.

The average single-family home price in Tulsa County reached $337,041 in October — up from $323,338 last fall — while the broader MLS climbed from $295,440 to $314,449.

While growth has slowed from pandemic-era surges, this kind of moderate appreciation points to a healthy and sustainable market.

Price Differences Across the Metro

Local variation remains significant:

-

South Tulsa and Jenks consistently lead with higher per-square-foot pricing due to top schools and newer construction.

-

Midtown Tulsa commands strong values thanks to location and character, particularly near Cherry Street and Utica Square.

-

Coweta, Sand Springs, and Sapulpa continue to offer affordability and larger lots, appealing to first-time buyers and those seeking space.

Steady Appreciation Trends

Tulsa County’s home prices have increased about 15% over the past three years, a slower yet more sustainable rise compared to the 2020–2022 boom.

Unlike some overheated U.S. markets, Tulsa’s growth has been supported by local job stability, affordable land, and migration from higher-cost states.

“Tulsa has always been a value-driven market,” says Deborah Green. “We’re not seeing the dramatic price swings other metros experience. Buyers and sellers here can make confident, informed decisions.”

Average single-family home sales prices in Tulsa County stayed consistently above the metro-wide average throughout the past year, with a summer peak in June 2025 before moderating into the fall.

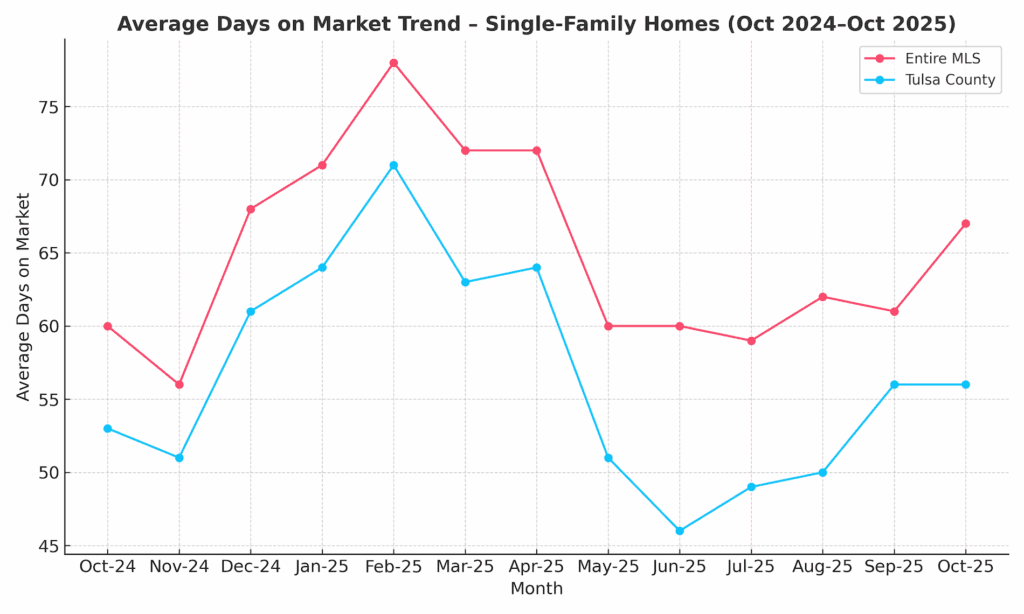

Days on Market: A Sign of Stability

The average days on market (DOM) ticked up slightly in October, as expected this time of year.

Tulsa County averaged 56 days, while the broader MLS came in at 67 days. This indicates homes in Tulsa proper are still selling faster than the regional average.

Breaking It Down by Price Point

-

Homes under $300,000 often receive strong interest within the first two weeks if in good condition.

-

In the $300K–$400K range, updated and move-in-ready homes remain competitive, often selling within 30–45 days.

-

Properties above $400K face more inventory and buyer comparison-shopping, stretching timelines closer to two months.

These numbers tell the story of a more thoughtful market, where buyers are taking their time and sellers must focus on presentation and pricing accuracy.

Homes in Tulsa County continued to sell faster than the metro-wide average throughout 2025, reflecting stronger buyer demand and lower inventory compared to the broader MLS.

Mortgage Rates: Slight Relief Boosts Affordability

As of early November 2025, the average 30-year fixed mortgage rate sits around 6.28% according to Mortgage News Daily.

That’s a welcome reprieve from the higher rates seen earlier in 2024.

Why It Matters

Even small shifts in rates make a big difference in affordability. A $325,000 home with 10% down at 6.28% translates to about $2,020 per month, roughly $200 less than the same purchase at 7%.

This added breathing room has brought more first-time and move-up buyers back into the market this fall.

Deborah’s Market Perspective

“We’re seeing a split market right now,” says Deborah Green, Real Estate Agent with Real Broker LLC.

“Entry-level homes that are in good condition are still moving quickly — sometimes with multiple offers. In the $300,000 to $400,000 range, updated homes are selling steadily, while those needing work are sitting a little longer. Over $400K, it’s all about presentation, condition, and value. Buyers at that price point have choices, so the homes that shine are the ones that sell.”

She also notes that the holiday season is far from a bad time to sell.

“Many sellers think about taking their home off the market during the holidays and relisting in January — but that can backfire. Today’s buyers can see online listing history, so removing and relisting doesn’t ‘reset the clock.’ Plus, anyone house-hunting in November or December is serious. They’re not tire-kickers — they’re ready to move.”

Pricing Strategy Insights

Setting the right price is one of the most important decisions a seller makes.

Even a small overpricing can stall interest and extend days on market.

Deborah’s Pricing Tips:

-

Review comparable sales from the past 60–90 days in your neighborhood.

-

Adjust for updates, condition, and lot size — small details matter.

-

Maximize your first 10 days on the market; that’s when buyers are most active.

-

Monitor showing feedback closely and adjust early if needed.

-

Remember: buyers are comparison-shopping online 24/7. Transparency wins.

“If your home is priced right, it will get activity immediately,” Deborah explains. “Tulsa buyers are smart — they know value when they see it.”

Fall in Tulsa: A Great Time to Move

As the leaves turn and Tulsa’s weather cools, the rhythm of the housing market naturally slows — but it doesn’t stop.

Fall is a time when motivated buyers come out. The weekend buzz of open houses continues, and Tulsa neighborhoods look especially inviting under golden canopies of color.

Events like Tulsa Oktoberfest, Pumpkin Town, and Lights On at Utica Square make this season one of the most enjoyable times to explore the city.

For many buyers, it’s easier to visualize how a home “feels” during this cozy time of year.

“Tulsa shines in the fall,” Deborah says. “You can see the neighborhood character, enjoy cooler weather for showings, and make a move before the holidays.”

Neighborhood Highlights

Tulsa County offers something for every lifestyle. Here’s a closer look at how different communities are performing — and why they appeal to today’s buyers:

South Tulsa

Families continue to flock to South Tulsa for its newer construction, top-rated schools, and proximity to shopping along Memorial Drive and 101st Street.

Communities like Bixby North, The Reserve at Battle Creek, and Forest Ridge remain popular for their family-friendly amenities, trails, and golf courses.

Midtown Tulsa

Demand remains strong for Midtown’s charm and convenience. Historic homes near Cherry Street, Utica Square, and Maple Ridge draw professionals and downsizers who appreciate mature trees, walkability, and unique architecture.

Broken Arrow

With its revitalized Rose District, walkable downtown, and a mix of older and new homes, Broken Arrow continues to be one of the most desirable suburbs. Buyers here enjoy excellent schools, parks, and affordability compared to neighboring cities.

Jenks & Bixby

Both suburbs see steady growth, driven by strong school districts and new construction. Homes priced between $450K–$600K are performing well if they’re staged and priced right, while luxury listings over $700K move more slowly but attract relocating professionals.

Owasso, Coweta & Sand Springs

Offering value and variety, these areas give buyers larger lots and small-town appeal within commuting distance of downtown Tulsa.

Coweta, in particular, has seen increased new construction and buyer interest in 2025, especially among families looking for affordability.

New Construction & Builder Activity in the Tulsa Metro

New-construction homes continue to play a significant role in the Tulsa housing market, especially as builders respond to pent-up demand from families seeking move-in-ready properties. While building slowed briefly during the high-interest-rate environment of 2024, activity in 2025 has rebounded across several key suburbs.

Where the Building Is Happening

-

Bixby: Ongoing development south of 151st Street offers modern floor plans and community amenities, including neighborhood pools and walking trails.

-

Broken Arrow: Subdivisions near the Creek Turnpike are expanding quickly, giving buyers newer homes under $400K—something rare just a few years ago.

-

Owasso & Coweta: Builders are emphasizing affordability and energy-efficiency, with many homes starting in the upper $200Ks.

Why It Matters for Buyers

New homes often carry builder incentives such as rate buydowns or closing-cost assistance. Combined with today’s 6.28% mortgage rates, those incentives can deliver real savings.

💬 “If you’ve been priced out of resale homes, don’t overlook new construction,” Deborah advises. “Many builders are motivated and willing to negotiate extras like fencing, appliances, or upgraded finishes.”

For sellers, new construction means more competition—especially in suburban markets. Homes that compete with new builds must be well-maintained and visually move-in-ready to hold buyer interest.

Tulsa Metro Economic Snapshot – Jobs, Growth & Stability

Behind every healthy housing market is a healthy local economy, and Tulsa continues to deliver. Employers in energy, aerospace, healthcare, and tech remain steady contributors to regional growth. Major companies such as AAON, Spirit AeroSystems, and Saint Francis Health System continue hiring, and new small businesses have flourished along corridors like Brookside and Cherry Street.

Why It Matters for Real Estate

-

Job Stability: Consistent employment keeps local demand strong and delinquency rates low.

-

In-Migration: Tulsa’s cost of living—roughly 15–20% below the national average—continues to attract remote workers and families relocating from higher-priced metros like Dallas and Denver.

-

Infrastructure Investment: Projects such as the Route 66 Experience and improvements near Downtown Tulsa’s Arena District are spurring nearby housing interest and revitalization.

“Economic diversity is Tulsa’s safety net,” Deborah explains. “Even when national markets wobble, we stay steady because our job base and housing costs are so balanced.”

Why Selling During the Holidays Works

Conventional wisdom says to wait until spring — but in Tulsa, the holidays can be a surprisingly effective time to sell.

Here’s why:

-

Less competition: Fewer listings mean your home stands out.

-

Motivated buyers: Those shopping during the holidays often need to move soon.

-

Curb appeal advantage: Seasonal décor makes homes feel welcoming and memorable.

-

No “relist stigma”: Taking a home off the market and re-listing in January can signal to buyers that it didn’t sell before.

“I’ve sold many homes in December,” Deborah notes. “Buyers relocating for work or aiming to close before year-end are some of the most decisive. Don’t underestimate them.”

Looking Ahead: What to Expect in Winter 2025

As the year winds down, Tulsa’s housing market should remain steady.

Mortgage rates are likely to hover in the mid-6% range, maintaining affordability while preventing overheated demand.

Modest inventory growth may offer buyers more options, but sellers who present move-in-ready homes will continue to see strong results.

“Tulsa isn’t a boom-and-bust market,” Deborah says. “It’s consistent and resilient. Our balance of affordability, amenities, and lifestyle makes it one of the most stable real estate markets in the country.”

Market Outlook for 2026

Heading into 2026, most analysts expect steady appreciation, continued suburban growth, and a balanced pace of transactions.

Bixby, Coweta, and Owasso are projected to see moderate price gains as new construction catches up with population growth.

In central Tulsa, revitalization projects in downtown and the Pearl District will keep buyer interest high for those seeking urban living with character.

“We’re in a sustainable market phase,” Deborah explains. “Prices are holding firm, builders are active again, and buyers have choices. It’s a healthy place to be.”

What This Means for Buyers and Sellers

For Buyers

-

Slightly lower rates improve monthly affordability.

-

More inventory above $400K creates opportunities for negotiation.

-

Updated homes under $400K remain hot — be ready to act fast.

-

Explore South Tulsa Homes for Sale or Midtown Tulsa Homes for Sale to start your search.

For Sellers

-

Condition matters: Fresh paint, curb appeal, and small repairs pay off.

-

Presentation counts: Staging helps buyers visualize themselves in the home.

-

Timing is flexible: Serious buyers shop year-round, even during the holidays.

-

Smart pricing sells: Market data and strategy make all the difference.

Buyer Readiness Checklist for 2026

If you’re planning to buy a home in the Tulsa housing market in early 2026, now is the perfect time to start preparing. Many buyers think the process begins when they start looking at homes — but the most successful purchases begin months earlier with good planning, financial organization, and a clear understanding of the local market.

Here’s how to make sure you’re ready when the right home hits the market:

1. Get Pre-Approved Early

Mortgage pre-approval gives you clarity on your budget and shows sellers you’re serious. With rates hovering around 6.28%, knowing exactly what you can afford helps you move confidently when you find the perfect home.

💡 Tip: Local lenders familiar with Tulsa neighborhoods can provide tailored advice on taxes and insurance that out-of-state banks may overlook.

2. Fine-Tune Your Budget

Factor in costs beyond the mortgage — property taxes, homeowners’ insurance, utilities, and potential HOA fees. Tulsa’s affordability makes homeownership attainable, but every neighborhood is unique. Midtown may offer charm and walkability, while South Tulsa’s newer subdivisions provide space and amenities.

3. Narrow Down Your Priorities

Decide what matters most: location, schools, yard size, or updated features. Touring open houses or model homes in Broken Arrow, Bixby, and Jenks can help you distinguish what you truly want from what’s optional.

4. Follow Local Market Updates

Tracking market data now means you’ll recognize an excellent opportunity later. Watch price trends and days-on-market averages in your target area. Deborah posts monthly updates like this one — perfect for keeping you informed as the market shifts.

5. Connect with a Local Expert

Working with an experienced Tulsa real estate agent early can make a significant difference. Deborah Green has been helping buyers and sellers across the metro since 1999, and her insider knowledge of neighborhoods, schools, and local pricing will give you a clear advantage when you’re ready to buy.

“The more you prepare, the smoother the process,” Deborah says. “Even if you’re six months out, start planning now. Tulsa’s housing market rewards buyers who are ready to act.”

Thinking About Your Next Move?

Whether you’re buying your first home, upsizing, or downsizing, the Tulsa housing market offers opportunities in every season.

Let’s make your next move seamless and stress-free.

📞 Deborah Green, Real Estate Agent | Real Broker LLC

📍 Serving Tulsa, Broken Arrow, Bixby, Jenks, Owasso, Coweta, Sapulpa & Grand Lake communities

📱 918-282-6385

🌐 deborahsellstulsa.com

FAQ – Tulsa Housing Market

Q1. Is the Tulsa housing market slowing down?

Not exactly — it’s balancing. Updated and well-priced homes still sell quickly, while buyers can take a bit more time to make confident decisions.

Q2. Are home prices expected to rise in 2026?

Experts predict steady prices with mild growth as mortgage rates stabilize. Tulsa’s affordability will continue to attract buyers.

Q3. Is fall a good time to buy or sell a home in Tulsa?

Yes. With fewer competing listings and serious buyers in the market, fall and early winter often produce strong, efficient sales.