When homeowners think about selling a house, most focus on the sales price. That makes sense — it’s the biggest number on the page. But the number that really matters is what you net, not what your home sells for.

In Tulsa and the surrounding suburbs, many sellers are surprised at closing when they realize how many line items affect their bottom line. Commission, taxes, concessions, and closing fees all come into play, and if you haven’t seen those numbers ahead of time, it can feel confusing or even unsettling.

That’s why understanding the true cost of selling a home in Tulsa starts with a net sheet. A net sheet is a seller’s estimate that shows, in plain dollars, what you’re likely to walk away with after all typical selling costs are accounted for. It’s not guesswork — it’s a planning tool.

Whether you’re a move-up buyer trying to fund your next purchase, a downsizer planning for retirement, or a homeowner who simply wants clarity before listing, a net sheet removes uncertainty. It lets you make decisions based on real numbers instead of assumptions.

This guide explains exactly what goes into a Tulsa seller net sheet, what sellers typically pay, what they don’t pay, and why these details matter before you ever put a sign in the yard.

What Is a Net Sheet — and Why Tulsa Sellers Need One

A net sheet is an estimate of your seller proceeds, prepared before your home goes under contract. It starts with an expected sales price and subtracts the costs that sellers are typically responsible for in a Tulsa-area transaction.

What a net sheet does:

-

Shows estimated selling costs

-

Accounts for commission, taxes, and prorations

-

Reflects buyer concessions written into the contract

-

Helps you plan your next move with confidence

What a net sheet does not:

-

Replace your final settlement statement

-

Guarantee exact figures months in advance

-

Include buyer-only expenses

The goal is clarity, not perfection. A good net sheet is conservative and realistic, so you are not caught off guard later.

If you haven’t priced your home yet, the first step is to check your home’s value so the net sheet is based on current Tulsa market data rather than online estimates.

Commission: The Most Visible — and Misunderstood — Cost

Commission is usually the biggest cost on a seller’s net sheet, and it’s also one of the most misunderstood.

In a typical Tulsa transaction, commission is split between:

-

The listing broker

-

The selling (buyer’s) broker

These fees cover far more than just “putting a home on the MLS.” They include pricing strategy, marketing, showing coordination, contract negotiation, inspection management, and shepherding the transaction through closing.

Commission is agreed to before listing and should never be a surprise later. What matters more than the percentage is how effectively the home is priced, marketed, and negotiated — because even small pricing or concession differences can outweigh commission entirely.

Understanding how commission fits into the overall selling picture is part of Selling a Home in Tulsa and should always be reviewed alongside your net proceeds, not in isolation.

Seller-Paid Closing Costs in the Tulsa Area

This is where confusion often creeps in, so let’s be very clear.

In Tulsa and Oklahoma generally, sellers do not pay for the buyer’s title insurance policy. That is a common misconception and does not appear on seller net sheets here.

What sellers do typically pay are title company service and administrative fees, along with required state and county charges.

Common seller-paid closing costs in Tulsa include:

-

Title company closing fee

-

Abstracting and certification

-

Required court and lien checks

-

Documentary stamps (county-required transfer tax)

-

Recording fees

-

Courier or wire fees for mortgage payoff

These are operational costs of closing the transaction — not insurance premiums for the buyer.

While each line item may seem small, together they form a meaningful part of the seller’s total costs. Seeing them clearly on a net sheet helps eliminate last-minute confusion.

Property Taxes and Prorations (Often Overlooked)

Property taxes are another area where sellers are often caught off guard.

In Oklahoma, property taxes are prorated at closing, meaning:

-

Sellers pay their share of the tax year up to the closing date

-

Any past-due or unpaid taxes must be paid at closing

Depending on timing, this can be a noticeable deduction from proceeds. A sale later in the year, or one with unpaid taxes, will reflect a larger seller credit.

This is why two sellers with identical home prices can walk away with different net amounts. Timing matters, and a net sheet makes that visible early.

For sellers planning a purchase afterward, understanding this timing is especially important when reviewing Tulsa Housing Market & Cost of Living as part of overall affordability planning.

Repairs, Preparation, and Pre-Listing Costs

Not all selling costs show up on the closing statement.

Many sellers invest money before listing to make their home more market-ready. This may include:

-

Minor repairs

-

Touch-up paint

-

Landscaping cleanup

-

Professional cleaning

-

Small cosmetic improvements

These costs are optional, but they often influence how quickly a home sells and how much leverage a seller has during negotiations. Homes that show well tend to receive stronger offers with fewer repair demands later.

A smart net sheet discussion includes these anticipated expenses so they don’t feel like “extra” costs after the fact.

For homeowners selling and buying at the same time, the Move-Up Buyer Guide explains how to balance prep costs with purchase planning.

Buyer Concessions and Negotiated Credits

Buyer concessions are amounts that the seller agrees to credit toward the buyer’s closing costs or other contract items.

These concessions:

-

Are negotiated as part of the offer

-

Are clearly itemized on the net sheet

-

Reduce the seller’s net proceeds dollar-for-dollar

Not all concessions are the same. Some are tied to loan requirements, while others are purely contractual. This distinction matters, especially with FHA or VA financing.

A higher offer price with large concessions may net less than a lower price with minimal credits. A net sheet allows sellers to compare offers accurately, rather than focusing solely on price.

Understanding the buyer’s side of the transaction — including how offers are structured — is covered in Buying a Home in Tulsa and helps sellers anticipate negotiation patterns.

Mortgage Payoff and Liens

Your mortgage payoff is usually the largest single deduction on a net sheet.

Payoff amounts:

-

Change daily due to interest

-

May include more than one loan

-

Must be satisfied in full at closing

In addition to mortgages, any recorded liens, HOA balances, or unpaid obligations tied to the property must be cleared before ownership transfers.

This is why sellers sometimes see unexpected deductions late in the process. A thorough net sheet flags these possibilities early, so there are no surprises.

For general consumer guidance on closing disclosures and settlement statements, the Consumer Financial Protection Bureau closing disclosure guide provides a neutral overview.

What Tulsa Sellers Typically Do Not Pay

This section is important for clarity.

In a standard Tulsa transaction, sellers typically do not pay for:

-

Buyer’s title insurance policy

-

Buyer’s lender fees

-

Buyer’s appraisal

-

Buyer’s loan origination costs

-

Buyer’s inspection fees (unless negotiated)

These costs are the buyer’s responsibility unless specifically negotiated otherwise. A good net sheet separates seller responsibilities from buyer expenses so nothing is misattributed.

Why Net Proceeds Matter for Move-Up Buyers and Downsizers

For move-up buyers, net proceeds often fund:

-

Down payment on the next home

-

Closing costs

-

Reduced loan amounts

For downsizers, net proceeds may:

-

Pay off remaining debt

-

Fund retirement goals

-

Reduce monthly housing expenses

In both cases, guessing is risky. A net sheet gives you clarity before you make timing or pricing decisions.

If downsizing is part of your plan, Downsizing in Tulsa offers guidance tailored to this transition.

Understanding net proceeds helps sellers plan their next housing move.

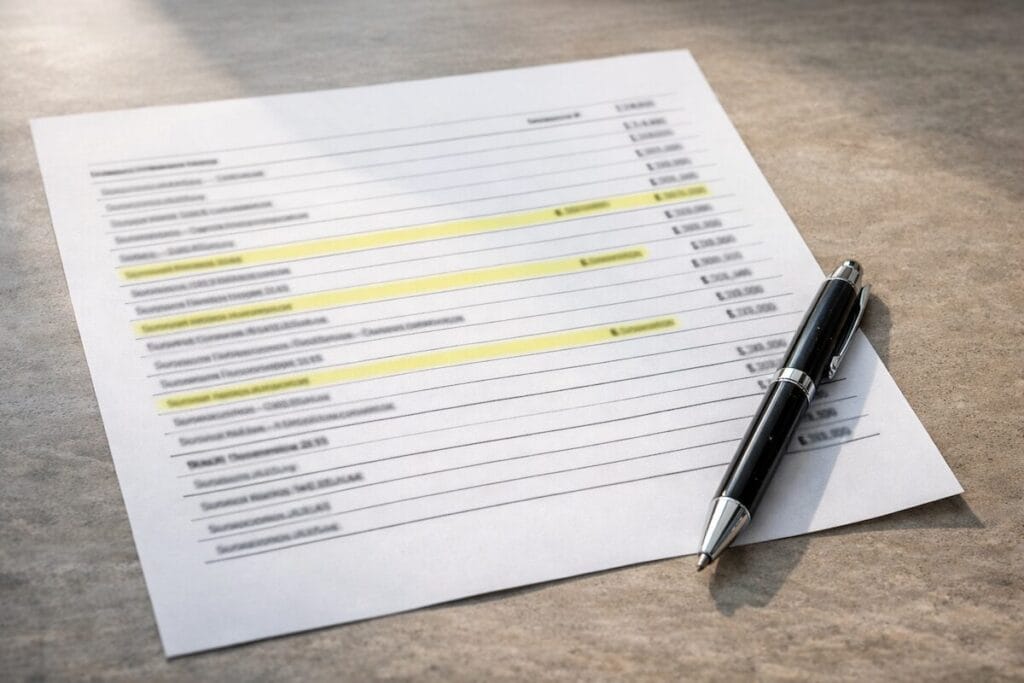

Typical Seller Costs vs Buyer Costs in a Tulsa Home Sale

| Cost Category | Typically Paid by Seller | Typically Paid by Buyer |

|---|---|---|

| Real estate commission | ✔️ | |

| Listing & selling broker fees | ✔️ | |

| Title company closing fee (seller side) | ✔️ | |

| Abstracting & certification | ✔️ | |

| Required court & lien checks | ✔️ | |

| Documentary stamps (transfer tax) | ✔️ | |

| Seller-side recording fees | ✔️ | |

| Property tax proration (seller share) | ✔️ | |

| Past-due property taxes | ✔️ | |

| Mortgage payoff(s) | ✔️ | |

| Buyer closing cost credits (if negotiated) | ✔️ | |

| Loan origination/underwriting/processing fees | ✔️ | |

| Appraisal | ✔️ | |

| Credit report & lender verifications | ✔️ | |

| Buyer’s title insurance (owner’s policy) | ✔️ | |

| Lender’s title insurance | ✔️ | |

| Attorney opinion / lender-required legal fees | ✔️ | |

| Buyer recording & transfer fees | ✔️ | |

| Prepaid interest | ✔️ | |

| Homeowners insurance (prepaid & reserves) | ✔️ | |

| Property tax reserves | ✔️ | |

| FHA upfront mortgage insurance (if applicable) | ✔️ | |

| Buyer inspections | ✔️ |

Frequently Asked Questions

Is a net sheet guaranteed?

No. It is an estimate, not a final statement. However, a well-prepared net sheet is usually very close to final numbers once under contract.

Should I get a net sheet before listing?

Yes. Reviewing one early helps you price correctly and avoid surprises later.

Do higher offers always mean more money?

Not necessarily. Concessions, repairs, and timing all affect net proceeds.

Can I reduce selling costs?

Strategic pricing, preparation, and negotiation usually have a greater impact than cutting individual fees.

Conclusion: Plan for Net, Not Just Price

The true cost of selling a home in Tulsa isn’t complicated — but it does need to be explained clearly. A net sheet replaces assumptions with facts and helps you make confident decisions about pricing, timing, and your next move.

If you want a clear, personalized breakdown with no pressure or sales pitch, schedule a low-pressure planning call and we’ll walk through your numbers together.