Your Guide to Upsizing with Confidence in the Tulsa Metro

If your home no longer fits your life, you’re not alone. Many move-up buyers in Tulsa reach a point where they’re ready for more space, more comfort, and a home that matches their next stage of life.

Whether you’re expecting a new baby, need a dedicated home office, want a bigger kitchen, or simply feel like you’ve outgrown your current space, this guide will help you navigate the move-up process smoothly.

I’ve helped hundreds of families upsize in the Tulsa metro since 1999. I know the questions, the stress points, the timing challenges — and the best strategies to help you move into a home that truly works for you.

If you’re early in the process, you may also want to start with my Buying a Home in Tulsa guide, which walks through the full buying process step by step.

Why move-up buyers in Tulsa Are Making a Change

Most homeowners decide to upsize because of one (or several) of these reasons:

A growing family

Needing more bedrooms or flex space

Wanting a bigger kitchen or living area for hosting

Remote work or home office needs

Desiring a newer or more modern home

Wanting a larger yard or outdoor living space

Moving into a preferred school district

Looking for long-term comfort and value

If any of these sound familiar, it may be time to explore your options.

The Biggest Question: Should You Buy or Sell First?

move-up buyers in Tulsa have two paths — and each has its pros and cons.

Option 1: Buy First

Ideal if:

You want time to find the perfect home

You don’t want pressure to accept the first offer on your current home

You qualify for overlapping mortgages or can tap equity

Pros:

Less stress and more control

You move on your timeline

No temporary housing needed

Cons:

May carry two mortgages temporarily

Option 2: Sell First

Ideal if:

You want to use equity for the next down payment

You prefer a clear financial picture first

Pros:

Less financial overlap

Stronger buying power with a clean offer

Cons:

May require temporary housing or quick decisions

Not sure which is right for you?

I’ll help you walk through timelines, finances, and market conditions to find the strategy that fits your goals and comfort level.

If you want a deeper breakdown of how this works in real life — including timelines, contingencies, and financing scenarios — I’ve laid it all out in my Buy and Sell a Home Simultaneously in Tulsa guide.

Want a Clearer Way to Think Through This?

If you’re feeling stuck between buying first, selling first, or waiting for the “right time,” I put together a short playbook to help you think through your options — calmly and clearly.

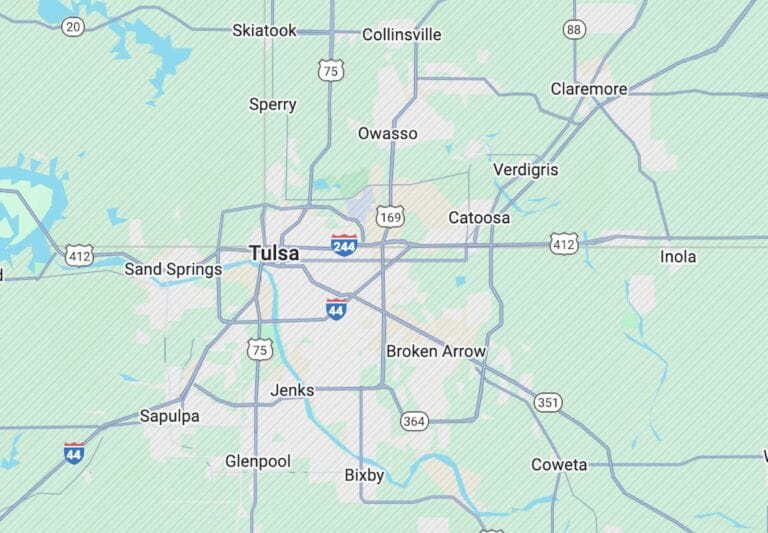

Popular Tulsa Areas for Move-Up Buyers

move-up buyers in Tulsa metro tend to gravitate toward neighborhoods with:

Larger or newer homes

Strong school districts

Convenient access to dining, shopping, and parks

Great resale value

Top areas include:

South Tulsa

Beautiful, well-established neighborhoods with larger homes and great access to shopping and schools.

Bixby

Newer construction, community amenities, and some of the top schools in the metro.

Jenks

Highly sought-after for its schools, community feel, and riverfront development.

Broken Arrow

Strong value for the size and quality of homes, plus easy access to parks and retail.

Owasso

Newer neighborhoods, retail convenience, and strong schools close to the airport.

Midtown Tulsa

Move-up buyers who prefer charm and character often choose historic homes with expanded layouts and renovated spaces.

Want a deeper look at what daily life is like in each area? Explore my Tulsa Neighborhoods and Lifestyle guide to compare communities, schools, and local amenities.

Should You Consider New Construction?

Many move-up buyers look at new construction because it offers:

Modern layouts

Energy efficiency

Larger kitchens and open floor plans

Customization options

Low maintenance

Warranties for major systems

You already have a full guide on this, so link it here:

→ Read: Complete Guide to New Construction Homes in the Tulsa Metro

How Much Home Can You Afford When Upsizing?

Your equity plays a major role here.

Most Tulsa move-up buyers discover they have more buying power than they expected, especially if they’ve owned their home for several years.

I can connect you with trusted local lenders who can help you explore:

Pre-approval

Bridge loans

HELOC options

Equity strategies

Same-day buy-and-sell financing solutions

This ensures you know exactly what you can comfortably buy — before you start shopping.

If this is your first time navigating financing at this level, my First Steps to Buying a Home in Tulsa guide explains pre-approval and lender expectations in plain language.

The Move-Up Buyer Advantage in the Tulsa Market

In the Tulsa metro, move-up buyers often experience:

Strong demand for their current home

More inventory options in mid-range and upper price points

Better negotiating power

Solid long-term growth and resale value

Upsizing here is usually less stressful and more financially comfortable than in many comparable markets.

How I Help Move-Up Buyers

Move-up moves require coordination — and that’s where experience matters.

When you work with me, I’ll help you:

Create a clear, personalized timeline

Decide whether to buy or sell first

Understand your buying power with precision

Identify neighborhoods that fit your next chapter

Coordinate showings, offers, and negotiations

Prepare your current home to sell for top dollar

Handle both transactions with less stress and more confidence

My goal is to make this transition enjoyable — not overwhelming.

For a detailed look at how to prepare, price, and market your current home, you can also review my Selling a Home in Tulsa guide.

Most move-up buyers I work with start by thinking — not rushing.

That’s why I created a short playbook to help you get clarity before making any decisions.

Start Your Search for a Move-Up Home

Browse homes across the Tulsa metro to see what’s possible in your next chapter.

Want to Talk Through Your Move-Up Plan?

Whether you’re thinking about upsizing in the next few months or you’re ready to start now, I’m here to help you make a smart, confident move.