If you’re thinking about buying a home in Tulsa, one of the first questions on your mind is probably: how much cash do you really need to buy a home in Tulsa?” It’s a fair question, and the answer might surprise you. Whether you’re a first-time buyer just starting or a move-up buyer planning your next chapter, understanding the cash requirements upfront can help you plan smarter and avoid costly surprises.

The good news? You don’t need to have 20% down to buy a home in Tulsa. In fact, many buyers in Broken Arrow, Bixby, Jenks, and Owasso are getting into homes with far less. But there’s more to the equation than just the down payment. Between earnest money, closing costs, inspection fees, and moving expenses, the total cash you’ll need can add up quickly.

In this guide, we’ll break down exactly how much cash you need to buy a home in Tulsa, what those costs include, and how to prepare financially, whether you’re buying for the first time or moving up from your current home. Let’s dive in.

How much cash do you need to buy a home in Tulsa?

Most buyers need between 3% and 8% of the purchase price in total cash, depending on loan type, down payment, and closing costs. First-time buyers often need less, while move-up buyers may use home equity to reduce out-of-pocket costs.

How Much Cash Do You Need to Buy a Home in Tulsa?

When people ask how much cash they need to buy a home, they’re usually thinking about the down payment. But that’s only part of the picture. To get a clear view of your Tulsa first-time homebuyer cash requirements, you need to understand all the upfront costs involved in a real estate transaction.

Here’s what you’re typically paying for:

Down payment. This is the most significant chunk of cash you’ll need. It’s the percentage of the home’s purchase price you pay upfront, with the rest covered by your mortgage loan.

Earnest money deposit. This is a good-faith deposit you make when your offer is accepted, usually 1% to 2% of the purchase price. It shows the seller you’re serious and eventually goes toward your down payment or closing costs.

Closing costs. These are the fees associated with finalizing your home purchase, including lender fees, title insurance, appraisal costs, and more. In Tulsa, closing costs typically range from 2% to 5% of the purchase price.

Inspection and appraisal fees. You’ll want a home inspection to uncover any issues before you buy, and your lender will require an appraisal to confirm the home’s value. Expect to pay $600 to $1,000 for inspections and $400 to $500 for an appraisal in the Tulsa area.

Reserves and prepaid costs. Lenders often require you to have a few months of mortgage payments in savings (called reserves), plus prepaid items like property taxes, homeowners’ insurance, and mortgage insurance at closing.

Moving and immediate home costs. Don’t forget the cost of moving, buying new furniture, or handling minor repairs right after you move in.

When you add it all up, the cash needed to buy a home in Tulsa after selling or as a first-time buyer can range from 3% to 8% of the purchase price, depending on your loan type and situation.

How Much Is the Down Payment in Tulsa?

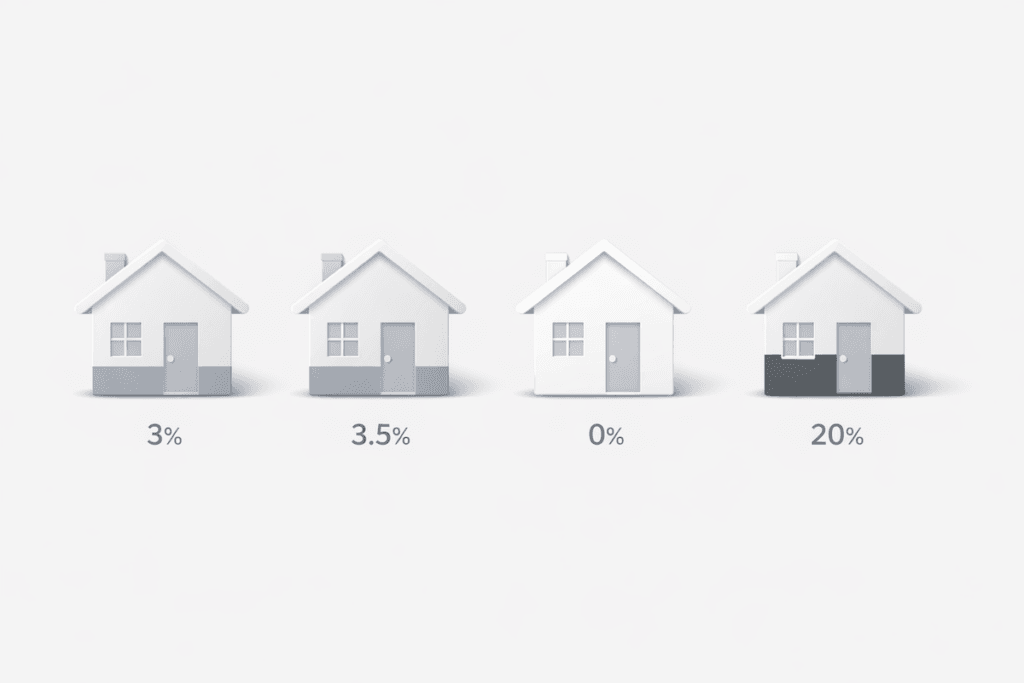

The down payment is the most significant single expense, but the amount you need depends on the type of loan you’re using. Let’s look at the most common options for Tulsa buyers.

Conventional Loans

With a conventional loan, you can put down as little as 3% – 5%. On a $250,000 home in Tulsa, that’s $7,500 to $12,500. If you put down less than 20%, you’ll pay private mortgage insurance (PMI) until you reach 20% equity, which adds to your monthly payment.

FHA Loans

FHA loans are popular with first-time buyers because they only require a 3.5% down payment. On that same $250,000 home, you’d need $8,750. FHA loans do come with mortgage insurance premiums, both upfront and monthly, but they’re easier to qualify for if your credit isn’t perfect.

VA Loans

If you’re a veteran or active-duty service member, a VA loan is one of the best deals available. You can buy a home with zero down payment and no PMI. This can significantly reduce the cash you need upfront, though you’ll still pay closing costs and other fees.

USDA Loans

USDA loans are available in some rural and suburban areas around Tulsa and also require no down payment. Eligibility depends on income limits and the property location, but if you qualify, it’s another way to buy with minimal cash.

Putting Down 20% or More

If you have the savings, putting down 20% eliminates PMI and can lower your interest rate. On a $250,000 home, that’s $50,000. This is more common with move-up buyers who are selling their current home and rolling equity into the next purchase.

What Are Closing Costs in Tulsa?

Closing costs are the fees you pay to finalize your mortgage and transfer ownership of the property. In Tulsa, these typically range from 2% to 5% of the purchase price. On a $250,000 home, that means $5,000 to $12,500.

Here’s what’s usually included in closing costs:

- Loan origination fees charged by your lender

- Title search and title insurance to protect against ownership disputes

- Appraisal fee to verify the home’s value

- Credit report fee

- Recording fees paid to the county to officially record the sale

- Prepaid property taxes and homeowners’ insurance

- HOA transfer fees if the home is in a homeowners association

Some of these costs can be negotiated. In a buyer’s market, sellers may agree to cover a portion of your closing costs to help close the deal. Your lender may also offer a lender credit in exchange for a slightly higher interest rate, which can reduce your upfront cash but increases your monthly payment.

Thinking about buying a home in Tulsa?

You can explore available homes, neighborhoods, and price ranges anytime at

👉 Search Homes

It’s a simple way to see what’s on the market while you’re planning your budget.

Earnest Money: What It Is and How Much You’ll Need

When you make an offer on a home in Tulsa, you’ll submit earnest money along with your contract. This deposit shows the seller you’re committed to the purchase. It’s typically 1% to 2% of the purchase price, so on a $250,000 home, that’s $2,500 to $5,000.

The earnest money is held in escrow and applied toward your down payment or closing costs at closing. If the deal falls through due to a contingency in your contract (like a failed inspection or financing issue), you usually get your earnest money back. But if you back out for reasons not covered by your contract, the seller may keep it.

Additional Upfront Costs to Budget For

Beyond the big-ticket items, there are a few other costs that can catch buyers off guard.

Home inspection. A thorough inspection in Tulsa typically costs $400 to $600, depending on the size and age of the home. It’s worth every penny to uncover potential problems before you commit.

Appraisal. Your lender will order an appraisal to confirm the home’s value, which costs around $400 to $500. If the appraisal comes in low, you may need to renegotiate the price or bring extra cash to closing.

Homeowners insurance. You’ll need to pay the first year’s premium upfront, which can range from $1,000 to $2,000 in the Tulsa area, depending on coverage.

Moving costs. Whether you hire professional movers or rent a truck, budget at least $500 to $2,000 for moving expenses.

Immediate repairs or purchases. Many buyers need to buy furniture and window treatments, or handle minor repairs, right after moving in. Set aside a few thousand dollars for these costs.

Tulsa First-Time Homebuyer Cash Requirements Explained

If you’re a first-time buyer worried about saving enough cash, several strategies can help you get into a home sooner.

Choose a low down payment loan. FHA, VA, and USDA loans all offer low or no down payment options. Even conventional loans allow as little as 3% down for first-time buyers.

Ask for seller concessions. In some market conditions, sellers may agree to cover part of your closing costs. This is more common when homes are sitting on the market longer.

Look into down payment assistance programs. Oklahoma offers programs that provide grants or low-interest loans to help with down payments and closing costs. Eligibility varies based on income and location.

Get a gift from family. Many loan programs allow you to use gifted funds for your down payment and closing costs. The gift must be appropriately documented with a gift letter.

Shop around for lender fees. Different lenders charge different fees, so comparing multiple offers can save you hundreds or even thousands at closing.

First-time buyer? Don’t go in unprepared.

Get the Tulsa First-Time Homebuyer Guide — your step-by-step roadmap for saving smart, understanding costs, and winning your offer.

👉 Grab your free guide today!

Cash Needed to Buy a Home in Tulsa After Selling Your Current Home

If you’re a move-up buyer selling your current home in Tulsa before buying your next one, the cash situation looks different. You’ll likely have equity in your current home that you can use toward your next purchase, significantly reducing the cash you need to bring to closing.

Here’s how it typically works:

Calculate your equity. Subtract what you owe on your mortgage from your home’s current value. If your home in Broken Arrow is worth $300,000 and you owe $200,000, you have $100,000 in equity.

Account for selling costs. You won’t keep all of that equity. After paying your agent’s commission (typically 5% to 6%), closing costs, and any repairs or staging costs, you might net $85,000 to $90,000.

Decide on your down payment. You can use some or all of your proceeds toward your next home. Putting down 20% or more eliminates PMI and can get you a better interest rate.

Bridge the timing gap. If you’re buying before your current home closes, you may need a bridge loan or to qualify for both mortgages at once, which requires strong income and credit. This is especially important when buying and selling a home in Tulsa simultaneously.

The cash needed to buy a home in Tulsa after selling is usually much lower than for first-time buyers because you’re rolling equity forward. However, you still need to cover any gap between your proceeds and the cash required for your next home.

How Much Cash Should You Have in Savings Beyond Closing?

Even after you’ve covered your down payment and closing costs, it’s smart to have extra cash in savings. Life happens, and homeownership comes with unexpected expenses.

Most financial advisors recommend having at least three to six months of expenses in an emergency fund. On top of that, keep a few thousand dollars set aside specifically for home maintenance and repairs. Things like HVAC repairs, roof leaks, or plumbing issues can cost thousands, and you don’t want to be caught off guard.

Some lenders also require reserves, especially if you’re putting down less than 20%. Reserves are a certain number of months’ worth of mortgage payments kept in your bank account. This shows the lender you can handle your payments even if your income temporarily drops.

| Buyer Type | Home Price | Down Payment | Estimated Total Cash Needed |

|---|---|---|---|

| First-Time Buyer (FHA) | $200,000 | $7,000 | $10,000–$14,000 |

| Move-Up Buyer (10% Down) | $350,000 | $35,000 | $38,000–$45,000 |

| VA Buyer (0% Down) | $275,000 | $0 | $6,000–$9,000 |

Real-World Examples: Cash Needed in Tulsa

To make this more concrete, let’s look at a few scenarios based on typical Tulsa home prices.

Example 1: First-time buyer using FHA loan on a $200,000 home

- Down payment (3.5%): $7,000

- Closing costs (3%): $6,000

- Earnest money (2%, applied to down payment): $4,000

- Inspection and appraisal: $1,000

- Total cash at closing: $10,000 (Plus $4,000 earnest money paid at the time of contract)

Example 2: Move-up buyer using a conventional loan on a $350,000 home with 10% down

- Down payment (10%): $35,000

- Closing costs (3%): $10,500

- Earnest money (2%, applied to down payment): $7,000

- Inspection and appraisal: $1,100

- Total cash at closing: $39,600 (Plus $7,000 earnest money paid at the time of contract)

Example 3: Veteran using a VA loan on a $275,000 home with zero down

- Down payment: $0

- Closing costs (3%): $8,250

- Earnest money (1%, applied to closing): $2,750

- Inspection and appraisal: $1,000

- Total cash at closing: $6,500 (plus $2,750 earnest money paid at the time of contract)

These examples show that the total cash you need can range from as little as $9,500 to nearly $50,000, depending on your loan type, down payment amount, and the home’s price.

Common Mistakes to Avoid When Saving for a Home

As you prepare to buy a home in Tulsa, watch out for these common pitfalls:

Draining your savings completely. Don’t put every dollar toward your down payment. Keep an emergency fund and budget for moving and immediate home costs.

Forgetting about closing costs. Many buyers focus only on the down payment and are surprised by the additional thousands needed at closing.

Making large purchases before closing. Buying a new car or opening new credit cards can hurt your debt-to-income ratio and mortgage approval.

Not shopping around for loan terms. Different lenders offer different rates and fees. Getting quotes from multiple lenders can save you thousands.

Skipping the inspection. A $500 inspection can save you from buying a home with $20,000 in hidden problems.

How the Tulsa Housing Market Affects Your Cash Needs

The Tulsa housing market has been relatively stable compared to larger metro areas, but market conditions still matter. In a hot seller’s market, you might face bidding wars that require larger earnest money deposits or waived contingencies, which increases your risk if something goes wrong.

In a buyer’s market, you have more negotiating power. Sellers may be willing to cover some of your closing costs or make repairs before closing, which reduces your cash needs. Right now, Tulsa’s market varies by neighborhood. Areas like Jenks and Bixby tend to be competitive with quicker sales, while other parts of the metro may offer more negotiating room.

Staying informed about Tulsa housing market updates can help you time your purchase and negotiate better terms. If you’re unsure about current conditions, working with a knowledgeable local agent who understands Tulsa, Broken Arrow, Owasso, and the surrounding areas can make a big difference.

FAQ: Cash Needed to Buy a Home in Tulsa

How much cash do I need to buy a home in Tulsa as a first-time buyer?

As a first-time buyer in Tulsa, you typically need a down payment of 3% to 5% of the purchase price, plus 2% to 5% for closing costs. On a $250,000 home, that’s roughly $12,500 to $25,000 total. With FHA loans requiring just 3.5% down and some programs offering down payment assistance, many first-time buyers can get into homes with as little as $10,000 to $15,000 saved.

Can I buy a home in Tulsa with zero down payment?

Yes, if you qualify for a VA or USDA loan. VA loans are available to veterans and active-duty service members with no down payment required. USDA loans are available in some suburban and rural areas around Tulsa for buyers who meet income requirements. You’ll still need cash for closing costs, inspections, and other fees.

What are closing costs in Tulsa, and can the seller pay them?

Closing costs in Tulsa typically range from 2% to 5% of the purchase price. This includes lender fees, title insurance, appraisal costs, and prepaid items. In some cases, you can negotiate for the seller to cover part or all of your closing costs, especially if the market favors buyers. This is called a seller concession and can significantly reduce the cash needed at closing.

How much earnest money do I need in Tulsa?

Earnest money deposits in Tulsa are typically 1% to 2% of the purchase price. On a $250,000 home, that’s $2,500 to $5,000. This money is held in escrow and applied to your down payment or closing costs at closing. If the deal falls through due to a contract contingency, you usually get it back.

What if I’m selling my current home and buying another in Tulsa?

If you’re selling first, you can use your home equity toward your next purchase, which significantly reduces the cash you need to bring to closing. After paying off your mortgage and selling costs, your net proceeds can cover most or all of your down payment. The key is coordinating the timing so you don’t end up carrying two mortgages or scrambling for temporary housing between closings.

Final Thoughts: Planning Your Home Purchase in Tulsa

Understanding how much cash you need to buy a home in Tulsa is the first step toward making your homeownership goals a reality. Whether you’re a first-time buyer exploring your options or a move-up buyer planning your next move, knowing these numbers helps you budget effectively and avoid surprises.

The total cash required depends on your loan type, the home’s price, and current market conditions. First-time buyers can often get started with less than $15,000 using low down payment loans and assistance programs. Move-up buyers selling their current homes typically have equity to roll forward, reducing their out-of-pocket costs significantly.

As you prepare to buy, focus on saving consistently, maintaining good credit, and getting pre-approved early so you know exactly what you can afford. And remember, buying a home in Tulsa is more than just the upfront costs. Plan for ongoing expenses like maintenance, property taxes, and insurance to ensure you’re financially comfortable in your new home.

If you’re ready to explore your options or want personalized guidance on buying a home in Tulsa, connecting with a local expert who understands the Broken Arrow, Bixby, Jenks, and Owasso markets can help you navigate the process with confidence. Understanding your cash requirements now puts you in control and one step closer to finding the perfect home.