The dream of owning a home in Green Country is one of the most exciting financial and personal milestones you can set for yourself. As you look ahead to the active housing market of 2025, taking the right steps now will transform you from a hopeful dreamer into a prepared, confident buyer.

For First-Time Homebuyers in Tulsa, the market presents a unique blend of opportunity and complexity. While the median sale price here (currently hovering around $235,000) remains competitive, careful preparation is the key to minimizing stress and maximizing your purchasing power.

This guide provides the seven essential steps you must complete over the coming months. By tackling this checklist now, you will enter the 2025 market ready to make a strong, winning offer.

1. Do a Deep Dive on Your Credit Score

Your credit score is the foundational number of your entire home-buying experience. It dictates the interest rate you are offered, which directly impacts your monthly payment and the total cost of your home over thirty years.

Understanding the Score Thresholds

For First-Time Homebuyers in Tulsa, the difference between an average rate and a great rate can be thousands of dollars in lifetime savings. More importantly, many of the best local and state-level assistance programs require a minimum score, typically between 620 and 640 FICO. If your score is below this range, your first and most crucial step is focused on improvement.

Action Plan for Credit Health

-

Review Your Reports: Obtain free copies of your credit reports from the three major bureaus (Equifax, Experian, TransUnion) and check for errors. Dispute any inaccuracies immediately.

-

Reduce Utilization: Keep your credit card balances low—ideally below 30% of your total limit, but below 10% is best for scoring.

-

Maintain Consistency: Pay all bills on time. A single late payment can severely damage your score.

Do Not: Open any new credit accounts (car loans, new credit cards) or close old, unused accounts, as this can negatively impact your credit history length right before applying for a mortgage.

2. Master the Full Cost: Beyond the Mortgage Principal

Many people calculate how much house they can afford based purely on the principal and interest (P&I) of the loan. However, in Oklahoma, you must factor in three other mandatory costs that make up your monthly housing expense: PITI.

The PITI Equation

-

P&I (Principal & Interest): What you are borrowing and the cost of borrowing it.

-

T (Taxes): Property taxes, which vary based on your specific location within the Tulsa Metro area. Taxes in the City of Tulsa may differ significantly from taxes in Broken Arrow or Jenks.

-

I (Insurance): Homeowner’s insurance, which covers the structure and contents against damage. Lenders require this.

-

I (Insurance, Part 2): Private Mortgage Insurance (PMI) or the Mortgage Insurance Premium (MIP). If you put down less than 20%, you will pay this additional cost until your equity reaches 20%.

Action Plan: Use an online PITI calculator, but input realistic Tulsa property tax and insurance estimates. This gives you a clear, honest number for your monthly commitment, ensuring you don’t fall in love with a home that stretches your budget too thin.

3. Uncover and Secure Local Down Payment Assistance

The largest hurdle for First-Time Homebuyers in Tulsa is often the upfront cash needed for the down payment and closing costs. Fortunately, Oklahoma offers some excellent programs designed to make homeownership more accessible. Understanding these programs is vital, as they essentially help you pay your own way into the home.

Key Tulsa DPA Programs

-

OHFA (Oklahoma Housing Finance Agency) Gold Program: This is a major statewide option. It typically offers up to 3.5% of the loan amount for down payment and closing cost assistance. This assistance is often provided as a zero-interest, deferred second mortgage.

-

Tulsa County First Home Program: Specifically for buyers in Tulsa County, this program provides a 3.5% forgivable second mortgage. The key here is “forgivable”—if you remain in the home for the specified period (often five years), you do not have to pay it back.

Action Plan: Visit the OHFA and Tulsa County Home Finance Authority websites to verify current income limits and educational requirements. Knowing your eligibility now allows you to budget based on having minimal out-of-pocket expenses at closing.

4. Get a Local Mortgage Pre-Approval (The Competitive Edge)

A pre-qualification is a quick, initial assessment based on what you say your finances look like. A formal pre-approval, however, is a commitment based on verified documentation.

Why Pre-Approval is Non-Negotiable

-

Know Your Budget: It locks down the maximum loan amount you qualify for, providing a firm ceiling for your home search.

-

Seller Confidence: When you are competing in a multiple-offer situation in a hot neighborhood like Brookside or Jenks, a seller will always prioritize an offer backed by a full pre-approval from a trusted local lender. It signals stability and reduces the risk of the deal falling apart.

Action Plan: Gather all necessary documents (pay stubs, tax returns, bank statements) and apply for a full underwriting pre-approval.

My Professional Tip: To ensure you are matched with the DPA program that best fits your situation, you need a lending partner who understands the local landscape. You can reach out to me for a couple of good local lenders who specialize in assisting First-Time Homebuyers in Tulsa.

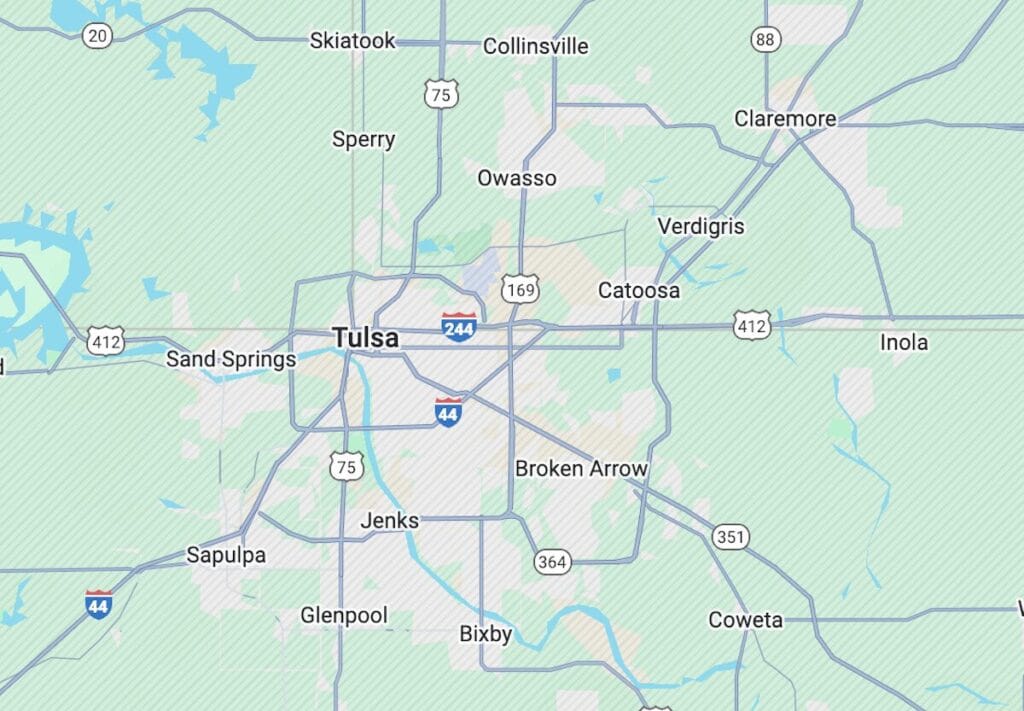

5. Define Your Hyper-Local Neighborhood Focus

The Tulsa Metro is a diverse collection of unique communities. Trying to search for a home across the entire area is inefficient and overwhelming. A successful first-time buyer focuses their search.

Lifestyle vs. Budget

Decide what is most important to your lifestyle:

-

Suburban Excellence: Areas like Bixby, Jenks, and Broken Arrow offer highly rated school districts, planned communities, and newer construction homes.

-

Urban Charm: Midtown Tulsa (e.g., Maple Ridge, Swan Lake) offers older homes with character, shorter commutes, and proximity to dining, parks, and downtown amenities.

-

Value and Growth: Areas slightly further out like Owasso or parts of South Tulsa may offer more square footage for your money.

Action Plan: Drive through your top 2–3 neighborhood choices at different times of the day (morning commute, weekend afternoon). Pay attention to amenities, traffic patterns, and community feel.

You might also like reading about Tulsa Neighborhoods.

6. Assemble Your Local Dream Team

Buying a home is a complex legal and financial transaction. Attempting to navigate it without expert guidance is the biggest mistake a first-time buyer can make. Your team includes your agent, your lender, and your home inspector.

The Value of a Local Agent

The Oklahoma purchase contract has specific provisions and timelines. A local real estate agent doesn’t just open doors; they protect your interests, negotiate fiercely on your behalf, and manage the dozens of deadlines required to close the sale.

My Promise to You: From pre-approval to closing, we simplify the complex Tulsa home-buying journey. We are your all-in-one local resource for market trends and financing. I ensure you understand every form and every deadline, so you never feel lost or pressured.

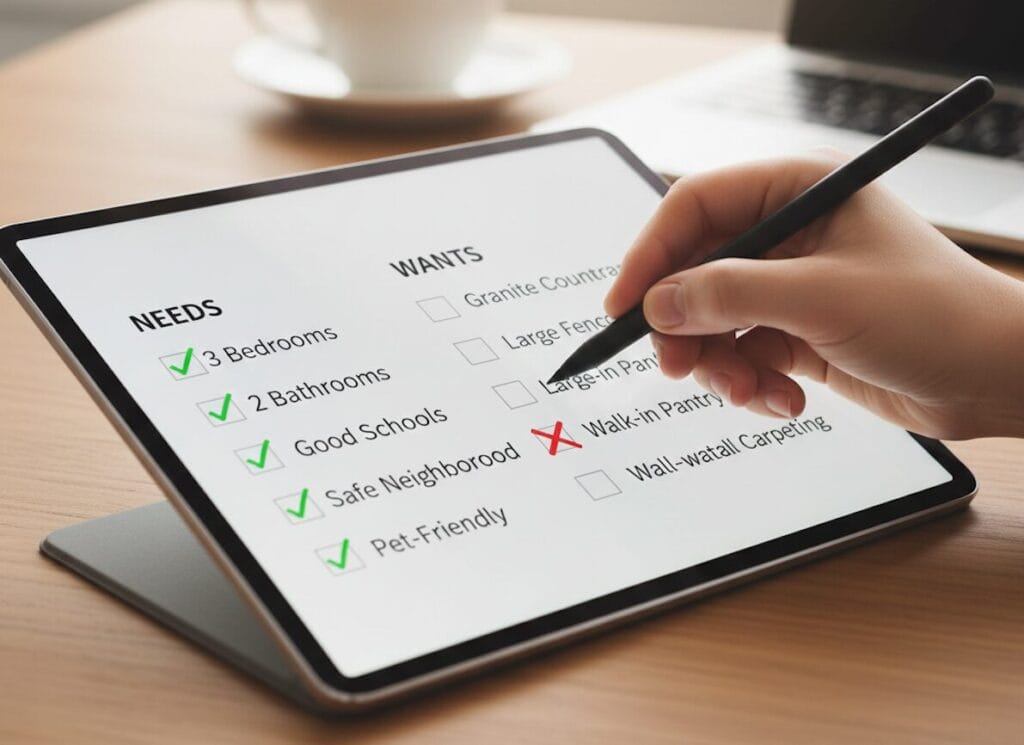

7. Prioritize Needs vs. Wants (The Reality Check)

It’s easy to get distracted by aesthetic features like paint color or a trendy backsplash. However, your first home purchase requires a clear-eyed focus on core functional elements.

The Needs List is Mandatory

-

Non-Negotiables: These are things like the minimum number of bedrooms or bathrooms, essential square footage, or a specific school district boundary. These items cannot be changed once you own the home.

-

Wants List is Flexible: These are things you desire but could live without or change later (e.g., granite countertops, a fenced yard, a specific paint color).

Action Plan: Before you look at a single listing, create a list of five actual needs. When you search, filter homes by those five needs. This discipline will save you time and prevent disappointment, making your competitive decision-making faster and less emotional.

Your Next Step: The Full Tulsa Homebuyer Guide

Completing these seven steps puts you in the strongest possible position for buying a house in Tulsa 2025. You will be financially prepared, credit-ready, and knowledgeable about the local market and the assistance programs available to you.

Ready to turn your preparation into a personalized plan?

Download the exclusive resource that walks you through the entire process, step-by-step.

👉 Click Here to Download Your Tulsa First-Time Homebuyer Guide