Your Complete Guide to Buying Your First Home in the Tulsa Metro

If you’re thinking about becoming a homeowner, welcome — you’re in the right place. Working with first-time homebuyers in Tulsa is one of my favorite parts of real estate. This is a big milestone, and you deserve someone who will walk you through the process clearly, calmly, and with your best interests at heart.

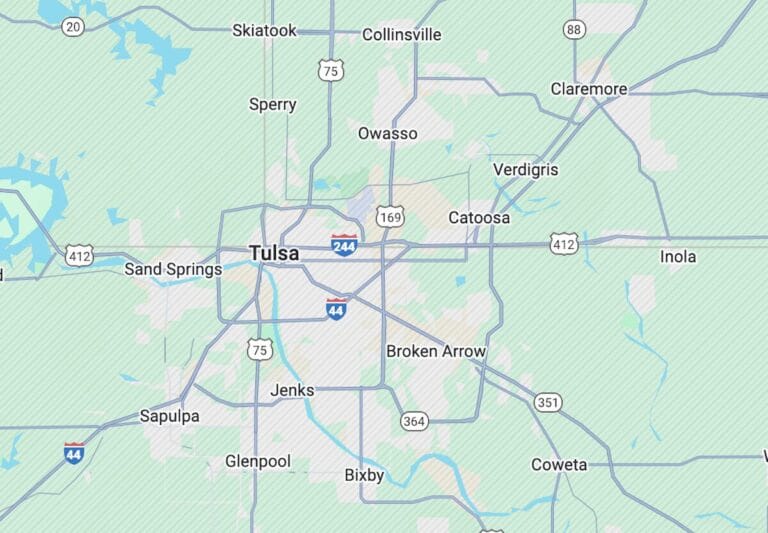

I’ve helped hundreds of families buy homes across Tulsa, Broken Arrow, Bixby, Jenks, Owasso, and the surrounding areas since 1999. My goal is to make your first home purchase feel exciting, not overwhelming — and to give you the confidence to make smart decisions every step of the way.

Start Your Tulsa Home Search

Browse starter homes, single-family homes, condos, and move-in-ready options.

Why First-Time Homebuyers Love Tulsa

Tulsa is one of the most affordable and approachable markets for new buyers in the country. You’ll find:

Reasonable home prices

Low cost of living

Strong inventory across many neighborhoods

Short commutes and easy transportation

Great suburban options with top-rated schools

A growing urban core for those wanting walkability

Plenty of first-time buyer–friendly price points

For many first-time homebuyers in Tulsa, owning a home here is far more attainable than in larger metros.

How to Buy a Home in Tulsa: A Simple, Step-by-Step Process

Buying a home doesn’t need to feel complicated. Here’s an easy overview to get you started.

1. Get Pre-Approved

A lender will help you understand your budget, monthly payment, down payment options, and loan programs available for first-time homebuyers in Tulsa. If you want a deeper breakdown of how pre-approval works, what documents you’ll need, and how to choose the right lender, start with Your First Steps to Buying a Home in Tulsa.

2. Start Looking at Homes

We’ll explore neighborhoods that fit your budget, lifestyle, and long-term goals. Want to see the full buying timeline in more detail? My Buying a Home in Tulsa guide walks through inspections, contracts, and closing step by step.

3. Make a Competitive Offer

I’ll walk you through what to offer, how to strengthen your terms, and how to negotiate.

4. Inspections & Appraisal

I’ll guide you through what to expect and how to handle repairs.

5. Closing Day

You get your keys and officially become a homeowner — the fun part!

First-Time Buyer Programs & Financing Options

There are several programs that can help first-time homebuyers in Tulsa:

Low- or zero-down-payment loans

Down payment assistance (income-based)

FHA loans with flexible credit guidelines

VA loans for eligible veterans

USDA loans for qualifying rural areas

Conventional loans for strong credit profiles

Not sure what fits your situation?

I can connect you with trusted local lenders who specialize in helping first-time homebuyers.

Best Neighborhoods for first-time homebuyers in Tulsa

These areas tend to offer great value, strong resale potential, and a variety of starter homes:

Broken Arrow

Safe, family-friendly, and tons of options in the $200s–$300s.

Bixby

Newer communities and updated homes with great schools.

Jenks

Harder to find starter homes, but strong value and excellent schools.

Owasso

Good mix of older and newer homes with retail convenience.

Midtown Tulsa

Charming, historic homes with great walkability.

Sand Springs & Sapulpa

Affordable and growing in popularity for buyers wanting more space.

New Construction for first-time homebuyers in Tulsa

Many buyers are surprised to learn that new construction can be an option, even for a first home. Some builders offer:

Attractive incentives

Standard upgrade packages

Energy-efficient features

Flexible financing options

Curious whether new construction could work for your first home? My Complete Guide to New Construction Homes in the Tulsa Metro breaks down costs, incentives, and what to watch for.

What first-time homebuyers in Tulsa Should Avoid

A few common mistakes I help my clients steer clear of:

Overstretching your budget

Skipping pre-approval

Falling in love with a house before knowing the payment

Waiving inspections

Underestimating closing costs

Choosing a home that doesn’t match long-term needs

With the right guidance, you can avoid costly missteps and feel confident at each stage.

Read the Full Guide for First-Time Homebuyers in Tulsa

Your full step-by-step guide covers everything from credit prep to closing day.

How I Help First-Time Homebuyers in Tulsa

When we work together, you get:

A clear explanation of the process

Honest, friendly guidance

Neighborhood recommendations based on your needs

Strong negotiation on your behalf

Trusted lender, inspector, and service-provider referrals

Support before, during, and after closing

You’ll always feel informed — and never pressured.

Ready to Buy Your First Home in Tulsa?

Whether you’re ready to start touring or simply want to learn more, I’m here to help make your first home purchase smooth and stress-free.