If you’re thinking about moving up to a bigger home or downsizing to something more manageable in the Tulsa metro area, you’re probably wrestling with this question:

How do I buy and sell home simultaneously without ending up homeless… or stretched too thin with two mortgages?

And let me tell you something — this is not a “silly” or “simple” question.

It’s actually one of the smartest and most responsible questions a homeowner can ask.

Because when you decide to buy and sell home simultaneously, you’re making two of the biggest financial decisions of your life… at the exact same time.

You’re juggling:

-

Your current equity – What is my home worth?

-

Your next mortgage

-

A changing interest rate environment

-

A competitive housing market

-

Your family’s living situation

-

Your emotional connection to your home

-

AND your future goals

That’s not small stuff.

I’ve been helping Tulsa families make this exact transition since 1999, and I can confidently tell you this:

The people who succeed aren’t the ones with the most money — they’re the ones with the clearest plan.

Not the fanciest house.

Not the biggest down payment.

Not the boldest risk takers.

The ones who succeed are the ones who take time to understand the process, their options, their finances, and themselves before making their move.

This guide is designed to give you clarity, not confusion.

It covers not just your options — but the emotional, financial, and logistical realities of selling and buying a home at the same time in Tulsa, so you walk into this transition prepared, not panicked.

Why This Process Feels So Stressful (And Why That’s Completely Normal)

When someone sits down with me and says they want to buy and sell home simultaneously, the very next thing they usually say is:

“I don’t know how people even do this without losing their minds.”

And honestly?

That’s a completely fair statement.

Because this process is stressful — not because you’re doing anything wrong — but because it naturally combines a lot of pressure points all at once.

You’re not just moving to a new house.

You’re managing two major real estate transactions while your daily life is still happening in the background:

work, kids, schedules, life, routines, relationships.

At the same time, you’re dealing with:

-

Inspection anxiety (“What if something major turns up?”)

-

Appraisal uncertainty (“What if my house or the new one doesn’t appraise?”)

-

Negotiation stress (“Am I getting a good deal on both sides?”)

-

Housing contingency fears (“What if one deal falls apart?”)

-

Emotional attachment to your current home

-

Excitement, anticipation, and sometimes even guilt about leaving

-

The pressure of making the “right” decision

It’s both exciting… and deeply exhausting.

But here’s the part that often surprises people:

Most of that stress is psychological, not financial.

It’s the fear of the unknown.

The fear of losing control.

The fear of making a mistake.

And that’s why your Tulsa move up home strategy cannot be based on numbers alone.

It has to consider your comfort level, your personality, and your emotional bandwidth too.

Because real estate decisions aren’t just made on spreadsheets — they’re made by real people.

The 3 Core Strategies to Buy and Sell Home Simultaneously

There are three primary ways to approach this process. Not one of them is perfect. But each one works beautifully… for the right person and the right situation.

Option 1: Sell First, Then Buy

(Expanded Deep Dive)

This is the most conservative and financially protective strategy.

And for many homeowners, especially first-time move-up buyers, this is the smartest place to start.

How It Works

You list and sell your current home first, then purchase your next home once you’ve closed or are close to closing.

This means your current home transaction is completed (or at least guaranteed) before you take on the next mortgage.

Why Some Homeowners Choose This

Most people who choose this option do so for very practical reasons:

-

They need their equity for the next down payment.

-

They don’t want the stress of two mortgage payments.

-

They value certainty more than convenience.

-

They sleep better knowing their house is already sold before they move forward.

And honestly? That’s completely reasonable.

This approach gives you something priceless in real estate:

✅ Clarity.

You know exactly how much money you’re walking away with.

You know what you can afford.

You know your timeline.

Advantages of Selling First

When you sell first, you gain several strategic benefits:

-

You’re a stronger buyer.

Sellers love non-contingent offers. When your home is already sold, your offer is more attractive in competitive Tulsa neighborhoods like Jenks, South Tulsa, or Bixby. -

You remove double mortgage risk.

You don’t have to stress about making two payments, two insurance policies, or two utility sets. -

Your lender is more comfortable.

Lenders view this scenario more favorably because your debt load is cleaner and easier to approve. -

You have financial certainty.

You know your exact net proceeds, not an estimate. -

You lower emotional pressure.

You make decisions based on logic, not desperation.

Challenges of Selling First

Now — let’s be real.

There are challenges too.

These are the ones I discuss openly with my clients:

-

You may need temporary housing (short-term rental, family, or extended possessions).

-

You might feel pressured to find a home quickly.

-

You could move twice instead of once.

-

You’ll need patience while waiting for the right home to come on the market.

But from a long-term perspective, these are temporary inconveniences compared to the financial stress of owning two homes at once.

Deborah’s Tulsa Reality Check

Most of my clients who sell first move into a short-term rental for 3–6 weeks.

Do they love it?

Not particularly.

Do they regret it?

Almost never.

Why?

Because they don’t carry two mortgages.

They don’t panic about payments.

They don’t feel rushed into overpaying for a house.

They make their next decision calmly — and smartly.

One Broken Arrow client told me after their move:

“That rental week felt long… but the peace of mind was priceless.”

And honestly, that’s the difference between temporary inconvenience and long-term stress.

Who Is Typically Best Suited for Selling First?

This option works especially well for:

-

First-time move-up buyers

-

Families who must use equity for down payment

-

Anyone uncomfortable with debt risk

-

People selling in competitive price ranges ($250k–$450k)

-

Anyone who prioritizes financial safety over convenience

And in the Tulsa market?

With how competitive some price points still are, selling first often sets you up to become a very strong buyer when the right home appears.

Sometimes the most stress-free decision isn’t the most convenient one.

But it almost always becomes the smartest one.

Option 2: Buy First, Then Sell

(Expanded Deep Dive)

This strategy is driven by comfort and control — but it carries significantly more financial responsibility. And while it can be the perfect solution for the right homeowner, it’s not something to enter into lightly.

When you buy first, then sell, you’re prioritizing stability and convenience — but you’re also taking on risk that needs to be carefully planned for.

How It Works

In this approach, you purchase your next home before listing or closing on your current one.

Once you’re settled in or close to moving in, you then list your existing home and wait for it to sell.

For many homeowners, this feels emotionally easier — because you always have somewhere to live, and there’s no temporary housing gap.

In other words, this is the strategy for people who say:

“I don’t care if it’s harder financially… I just don’t want to feel rushed or displaced.”

And I fully understand that mindset.

Why Some Homeowners Prefer This Option

The idea of selling first makes some people deeply uncomfortable — especially if they have:

-

Children in school

-

Pets

-

Work-from-home schedules

-

Older parents in the house

-

Busy personal calendars

They want stability.

They want a smooth transition.

They want to pack once, move once, and be done.

And emotionally? That makes a lot of sense.

Here are the most common reasons my Tulsa clients choose this approach:

-

They don’t want to disrupt family life with temporary housing

-

They’re afraid of missing “the perfect house”

-

They want control over their move-out timeline

-

They prefer comfort over uncertainty

-

They already have strong financial reserves

For some, this strategy is worth the added complexity — but it has to be done with eyes wide open.

Advantages of Buying First

There are real advantages to choosing this path — and when it works properly, it can feel incredibly smooth.

Here’s what homeowners love about it:

1. No Housing Gap

There’s no period of uncertainty between sale and purchase.

You always have a roof over your head.

This is particularly important for families with kids, pets, or work-at-home demands where disruption isn’t an option.

2. Only Move Once

You move straight from your old home into your new one.

No temporary rentals.

No living out of suitcases.

No rushing storage units.

For many families, this alone makes the option appealing.

3. Less Emotional Pressure When Buying

You don’t feel rushed into finding “anything that will work.”

You can take your time.

You can say no.

You can be selective.

That emotional relief sometimes leads to better buying decisions.

4. Easier to Stage a Vacant Home

Once you move out, we can:

-

Deep clean

-

Repair freely

-

Stage properly

-

Photograph perfection

Vacant homes are often easier to present beautifully — which helps with marketing.

The Financial Risks (And Why They Matter)

Now let’s talk about the side most people underestimate.

Buying first means you will temporarily carry two properties — and sometimes two mortgages.

Here’s what that involves:

-

Two mortgage payments

-

Two insurance policies

-

Two sets of utilities

-

Two properties to maintain

-

Two financial responsibilities

-

Plus moving expenses

Even financially strong families feel this pressure after a while.

Most homeowners think:

“It’ll only be a few weeks.”

Sometimes it is.

Sometimes it isn’t.

In Tulsa, the average timeline can vary greatly depending on:

-

Your home’s price range

-

Your neighborhood

-

Market conditions

-

Pricing strategy

-

Buyer demand

And if your home sits for 60–90 days instead of 30?

That financial exposure starts to feel very real.

Who This Strategy Is Truly Best For

This option can work beautifully — for the right household.

Based on my experience helping Tulsa families since 1999, it works best for:

-

Downsizers with significant equity

-

Families with very stable, predictable income

-

People with strong cash reserves

-

Buyers who could carry two payments for 3–6 months if needed

-

Those selling in highly desirable neighborhoods

-

Clients with very flexible risk tolerance

It’s not about having a lot of money.

It’s about having a lot of financial breathing room.

Big difference.

If you’re reading this because you’re downsizing rather than moving up, the strategy — and the emotions — can look a little different. Downsizers often have more equity flexibility, but they still face the same timing, financing, and transition challenges when buying and selling at the same time. I’ve put together The Complete Guide to Downsizing in Tulsa to walk through the financial options, emotional considerations, and practical steps specific to downsizing, so you can make decisions that feel right — not rushed.

Deborah’s Local Tulsa Reality Check

In Tulsa, lenders are much more careful today than they were even five years ago.

Many buyers assume their lender will approve them for two mortgages.

But assumptions are dangerous in real estate.

Here’s what lenders usually look at in these situations:

-

Debt-to-income ratio

-

Total monthly obligations

-

Cash reserves

-

Current interest rate environment

-

Stability of income

-

Length of employment

-

Remaining mortgage balance

-

Potential rental value (if used as offset)

And in many cases?

They still count your existing mortgage fully until your home actually sells.

That’s why I don’t let my clients move forward with this option until they’ve spoken with a trusted local lender who understands Tulsa property values, income structures, and underwriting realities.

Because online lenders don’t always understand how Tulsa actually works.

Emotional Considerations of Buying First

Here’s something people don’t expect:

Buying first can feel calm… at first.

But once you move into your new home and your old one is still sitting on the market, anxiety can start creeping in.

Suddenly, the question becomes:

“Why hasn’t it sold yet?”

That’s a very different emotional stress than temporary housing.

Instead of physical disruption, it becomes financial pressure plus psychological tension.

Some people handle that just fine.

Others don’t realize how heavy it feels until they’re in it.

And part of my job is helping clients decide honestly which kind of stress they’d rather live with.

Temporary inconvenience?

Or ongoing financial pressure?

Both are valid — but they feel very different.

Option 3: Coordinate and Buy and Sell Home Simultaneously

This is what most people mean when they say they want to do it “at the same time.”

How It Works

You list your current home, go under contract, and then make an offer on your next home with aligned closing dates.

Advantages:

-

No double mortgage payments

-

No rental stay

-

One move

-

Financial efficiency

Disadvantages:

-

Requires tight coordination

-

High dependency on timelines

-

Must have backup housing options

-

Emotions run high

Who this works best for:

-

Homeowners ready for complexity

-

Clients with flexible timelines

-

People working with highly organized agents

Deborah’s Real-World Experience:

This is the majority of what I do with move-up buyers in Tulsa.

And experience makes or breaks this approach.

One missed timeline or poor communication can collapse both sides. That’s why I stay deeply involved in every step — not delegated to a team.

Financial Factors Most People Overlook

Most articles talk about logistics — but very few talk about actual financial structure.

Here’s what really affects your ability to buy and sell home simultaneously:

1. Debt-to-Income Ratio (DTI)

Even if your home is listed, many lenders still count the mortgage until it sells.

2. Access to Liquid Cash

Do you have funds for:

-

Earnest money

-

Inspections

-

Appraisal

-

Moving costs

-

Overlap costs (if delayed)

3. Risk Tolerance

Some clients sleep fine carrying two mortgages.

Others can’t.

Your comfort level matters.

Emotional Strategy for Selling and Buying a Home at the Same Time

Let’s talk about the part no one admits.

This process often involves:

-

Letting go of a family home

-

Uncertainty about the next chapter

-

Financial risk

-

Emotional exhaustion

Some of my clients have lived in their home 20+ years.

You’re not just changing addresses — you’re closing a chapter.

That emotional side affects:

-

Negotiations

-

Decision speed

-

Risk tolerance

-

Your overall experience

A good Tulsa move up home strategy considers this, not just data.

Advanced Tools That Help When You Buy and Sell Home Simultaneously

Here are tools we use regularly in Tulsa transactions:

1. Home Sale Contingency

Your purchase depends on your home selling.

Used best in:

-

Balanced markets

-

Luxury price tiers

-

Slower neighborhoods

2. Rent-Back Agreements

Buyers allow you to stay 30–60 days after closing.

This can bridge timing gaps beautifully.

3. Bridge Loans

Temporary financing to cover your next purchase before your home sells.

Best for:

-

High-demand homebuyers

-

Relocation situations

-

High-equity homeowners

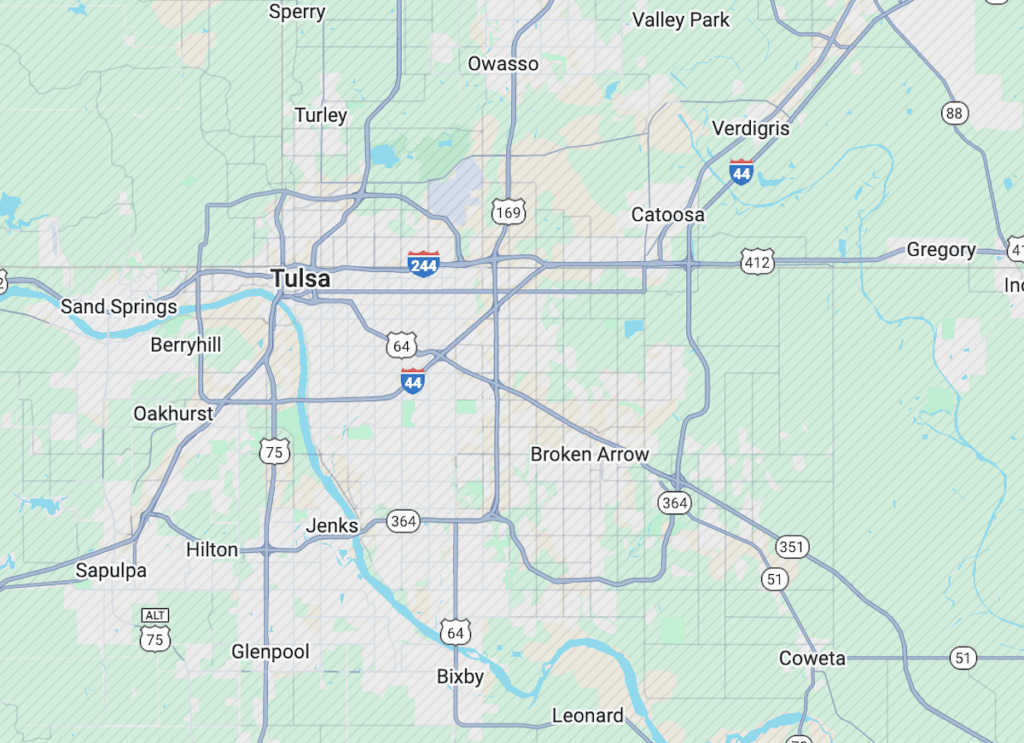

Tulsa Market Reality (Deep Dive)

Real numbers and reality:

Neighborhood Speed Differences:

-

Jenks & South Tulsa: Multiple offers still common

-

Broken Arrow: Balanced, timing flexibility possible

-

Bixby: Competitive mid-range homes

-

Owasso: Expanding inventory

-

Glenpool/Sapulpa: More time to negotiate

Price Range Behavior:

-

Sub-$400k: Fast movement if well priced

-

$400k–$700k: More balanced, some inventory build-up

-

$700k+: Slower absorption rate — helpful for coordination

This matters because your position as a seller and buyer depends entirely on your price tier and location.

Extended Timeline for Simultaneous Transactions

Here’s a realistic timeline I use with clients:

10–12 Weeks Out:

-

Full market evaluation

-

Lender scenario planning

-

Risk assessment

-

Neighborhood research

8–10 Weeks Out:

-

Pricing strategy

-

Pre-inspection prep

-

Repairs & staging

-

Photography

6–8 Weeks Out:

-

Listing launch

-

Active house search

-

Tour homes and refine needs

Under Contract:

-

Offer strategy on new home

-

Timeline alignment

-

Contingency negotiation

-

Appraisal coordination

2–3 Weeks Before Closing:

-

Utility transfers

-

Title review

-

Final lender checks

-

Backup housing confirmation

Closing Week:

-

Final walkthroughs

-

Document signing

-

Moving logistics

-

Transfer of keys

Biggest Mistakes When Selling and Buying a Home at the Same Time

Here’s what I see go wrong most often:

-

Emotional decisions instead of planned decisions

-

Overestimating what their home will sell for

-

Underestimating time on market

-

Assuming financing will “just work”

-

No backup housing plan

Every single one is preventable with guidance.

Why My Solo-Agent Model Works Better

Because when you buy and sell home simultaneously, communication matters more than ever.

You don’t want:

-

To repeat your story to 4 people

-

Mismatched timelines

-

Missed lender updates

You get one dedicated professional guiding both sides.

Let’s Build Your Strategy

Whether you’re upsizing, downsizing, or relocating, your situation deserves a tailored strategy.

📞 Call or text: 918-282-6385

🌐 Visit: deborahsellstulsa.com

Let’s create a clear path so you can buy and sell home simultaneously without chaos.