The Tulsa County Housing Market January 2026 update shows a market that continues to adjust gradually, with home prices rising year over year, inventory increasing slightly, and the pace of sales slowing just enough to change how buyers and sellers approach decisions early in the year.

January is often a quieter month in real estate, but it’s also one of the most telling. The data from January doesn’t just reflect activity for a single month — it often sets the tone for how the rest of the year unfolds. Buyers reassess affordability, sellers test pricing expectations, and the market begins to reveal whether momentum is building, flattening, or shifting.

In Tulsa County, January 2026 points to a housing market that is neither overheating nor retreating. Instead, it’s settling into a more balanced rhythm — one where preparation, pricing, and patience matter more than urgency.

This update walks through the January 2026 numbers in detail, explains what’s driving the changes, and translates the data into a practical context for buyers, sellers, and homeowners watching the Tulsa County housing market.

Tulsa County Housing Market January 2026: Key Statistics at a Glance

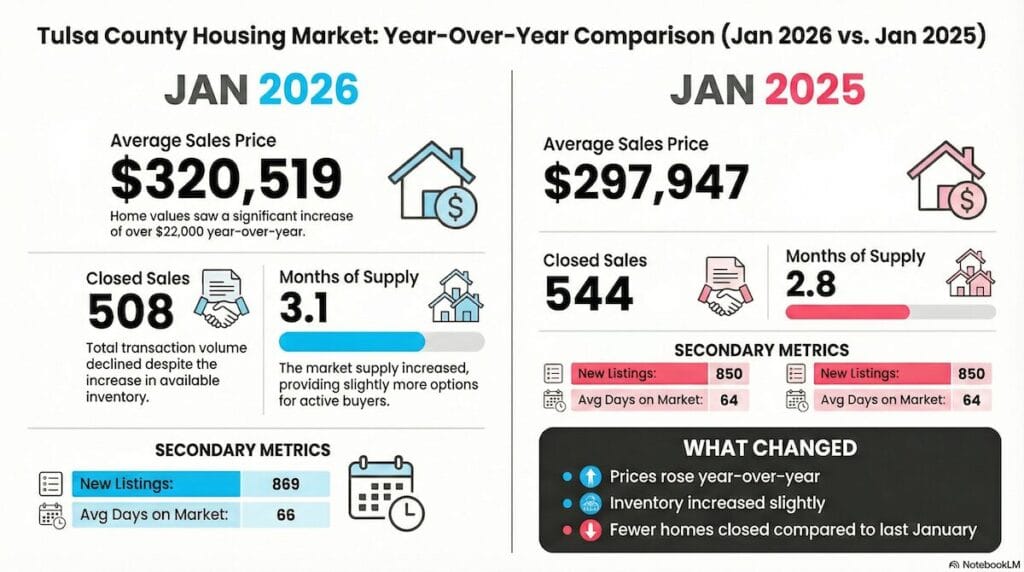

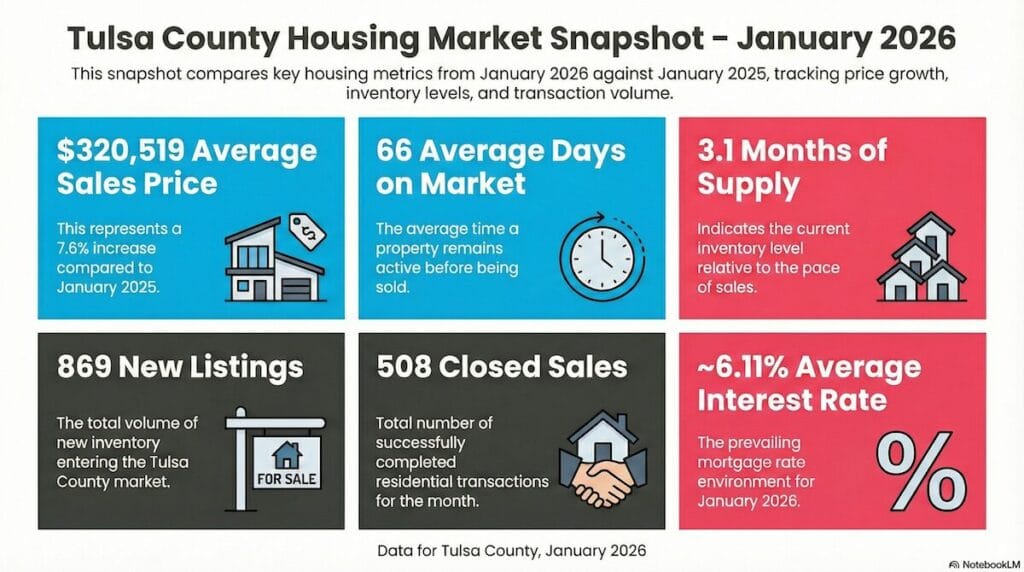

Before diving into interpretation, it helps to clearly lay out the data behind the Tulsa County Housing Market January 2026 update. Comparing January 2026 to the same month last year removes seasonal noise and highlights true year-over-year changes.

January 2026 vs. January 2025 — Tulsa County

| Metric | January 2026 | January 2025 | Year-Over-Year Change |

|---|---|---|---|

| Average Sales Price | $320,519 | $297,947 | +7.6% |

| Average Days on Market | 66 days | 64 days | +2 days |

| Months of Supply | 3.1 months | 2.8 months | ↑ |

| New Listings | 869 | 850 | ↑ |

| Closed Sales | 508 | 544 | ↓ |

| Average Mortgage Rate | ~6.11% | ~6.6% (approx.) | ↓ |

This table provides a quick snapshot of the market’s direction. Prices continue to rise, inventory has expanded modestly, and sales volume has slowed slightly — a combination that points toward normalization rather than volatility.

Home Prices in January 2026: Growth Without Frenzy

One of the most notable aspects of the Tulsa County Housing Market January 2026 update is the continued rise in average sales price. At $320,519, prices are up roughly 7.6% compared to January 2025.

That increase matters, but the way prices are rising matters even more.

This is not the rapid, across-the-board appreciation seen during the most competitive years of the market. Instead, price growth is becoming more selective. Homes that are:

-

Well-located

-

Well-maintained

-

Priced appropriately for current conditions

are still commanding strong values. Homes that miss one or more of those factors are seeing longer timelines and more negotiation.

For homeowners, this suggests that equity continues to build — but not automatically. Understanding how a specific home compares within its neighborhood is far more important now than relying on broad market averages.

If you’re tracking value as part of a longer-term plan, the Tulsa Housing Market & Cost of Living guide provides additional context beyond month-to-month changes:

👉 https://deborahsellstulsa.com/tulsa-housing-market-cost-of-living/

Days on Market: What a Slight Increase Really Signals

The average number of days on market increased from 64 to 66 days year over year. While that change is modest, it reflects a meaningful shift in buyer behavior.

In the Tulsa County Housing Market January 2026, buyers are taking more time to:

-

Compare similar homes

-

Review inspection results

-

Evaluate monthly payment scenarios

-

Decide whether a home truly fits their needs

This doesn’t indicate weakness. Instead, it reflects a market where buyers feel less pressure to rush, and sellers can no longer rely solely on speed.

For sellers, this means the early days of a listing matter more than ever. Homes that launch well — with accurate pricing and strong presentation — tend to attract activity sooner. Homes that start off misaligned often require adjustments later.

For buyers, longer days on market can create opportunity, particularly when sellers are motivated by timing rather than price.

Inventory and Months of Supply: Slowly Moving Toward Balance

With 3.1 months of supply, Tulsa County remains below the typically considered balanced market range (5–6 months). However, the increase from 2.8 months last year is important.

Rising inventory affects the market in subtle but meaningful ways:

-

Buyers have more options than a year ago

-

Sellers face more direct competition

-

Price sensitivity increases, especially in similar neighborhoods

Not all segments feel this equally. Entry-level homes often remain competitive, while move-up and mid-range homes show more variability depending on condition and location.

This environment is especially relevant for move-up buyers, who need to sell and buy in the same market. Timing, coordination, and pricing strategy play a larger role when inventory is expanding.

👉 https://deborahsellstulsa.com/move-up-buyers-in-tulsa/

New Listings vs. Closed Sales: Reading the Early-Year Signals

January 2026 brought more new listings than January 2025, but fewer closed sales. This gap often appears early in the year and reflects caution on both sides of the transaction.

Sellers are entering the market, but buyers are moving deliberately. Rather than signaling decline, this pattern usually indicates:

-

Buyers reassessing affordability

-

Sellers testing pricing expectations

-

Transactions shifting later into the spring

In many years, this gap narrows as seasonal activity increases. What matters most is how homes are positioned when buyer attention picks up.

Understanding this timing can be especially helpful for homeowners deciding whether to sell now or wait. Additional context on that decision can be found here:

👉 https://deborahsellstulsa.com/sell-in-tulsa/

Mortgage Rates in January 2026: A Stabilizing Factor

Mortgage rates remain a central influence on buyer behavior, even as the market adjusts to higher borrowing costs compared to previous years.

In January 2026, average rates hovered around 6.11%, according to data from Freddie Mac’s Primary Mortgage Market Survey (PMMS):

👉 https://www.freddiemac.com/pmms

While rates are still elevated relative to historic lows, the recent stability has allowed buyers to plan more realistically. Instead of waiting indefinitely for major drops, many buyers are:

-

Adjusting price expectations

-

Comparing monthly payments carefully

-

Negotiating price or concessions where possible

This shift has helped calm the market and reduce volatility. It has also reinforced the importance of preparation — especially for first-time buyers navigating affordability.

👉 https://deborahsellstulsa.com/buying-a-home-in-tulsa/

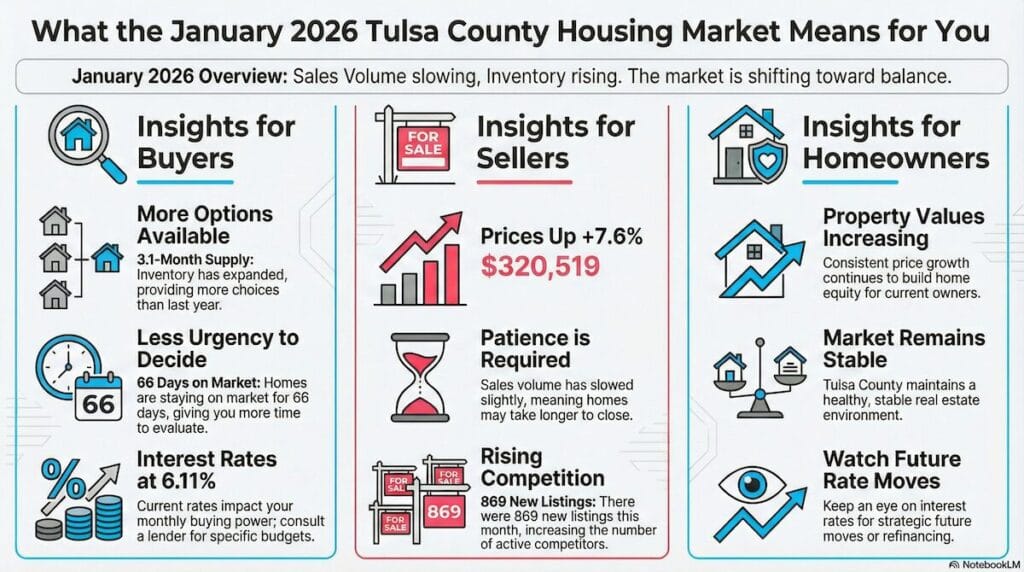

How the Market Feels by Buyer Type

Not all participants experience the Tulsa County Housing Market January 2026 the same way. Different buyer groups are responding differently to current conditions.

First-Time Buyers

First-time buyers remain active, but more cautious. Monthly payment sensitivity is high, and many are prioritizing affordability, condition, and long-term fit over speed.

Move-Up Buyers

Move-up buyers are balancing equity gains against higher interest rates. Coordinating the sale of an existing home with the purchase of a new one requires careful planning and timing.

Relocation Buyers

Relocation buyers often bring external equity or cash, making them less rate-sensitive. However, they remain value-conscious and compare Tulsa neighborhoods carefully.

👉 https://deborahsellstulsa.com/tulsa-neighborhoods/

What January 2026 Means for Sellers

For sellers, the Tulsa County Housing Market January 2026 reinforces several important themes:

-

Pricing accuracy matters more than ever

-

Condition and presentation affect timelines

-

Buyers are selective, not desperate

This is not a market where sellers can rely solely on momentum. Homes that are thoughtfully prepared tend to stand out, while others blend into growing inventory.

Understanding local competition — not just countywide averages — is critical when deciding how and when to list.

What January 2026 Means for Buyers

Buyers in January 2026 are operating in a market that offers more balance than in recent years.

Opportunities include:

-

More inventory to choose from

-

Greater ability to negotiate

-

Less pressure to waive protections

At the same time, desirable homes in strong locations continue to attract attention. Preparation, clarity, and patience remain key.

Interpreting Market Data Without the Noise

Housing market headlines often focus on extremes — crashes or booms — but most real estate markets move more gradually. The Tulsa County Housing Market January 2026 update is a good example of this.

The data shows adjustment, not alarm. Growth, not frenzy. And a market that rewards thoughtful decision-making rather than urgency.

For anyone watching the market — whether planning a move this year or simply tracking trends — January provides a useful baseline for what’s likely to come.

Looking Ahead Without Making Predictions

Rather than making forecasts, the January 2026 data offers a clearer understanding of where the market stands right now. Inventory, pricing, and buyer behavior are all evolving in small but meaningful ways.

Staying informed — without reacting to headlines — allows buyers and sellers to move with confidence when the timing is right.

Final Thoughts on the Tulsa County Housing Market January 2026

The Tulsa County Housing Market January 2026 reflects a market settling into balance. Prices are up, inventory is growing gradually, and the pace of sales has slowed just enough to change the dynamics of decision-making.

For homeowners, this means equity continues to build, but strategy matters.

For buyers, it means more choice and more time.

For sellers, it means preparation and pricing are essential.

Understanding these shifts early in the year provides clarity — not urgency — for the months ahead.

Market data can be helpful, but it rarely tells the whole story on its own. Timing, neighborhood trends, and personal goals all play a role that numbers can’t fully capture. If you’re watching the Tulsa County market and trying to figure out how these trends apply to your own situation, I’m always happy to talk it through. Sometimes a little context makes the numbers easier to understand.